Authors

Summary

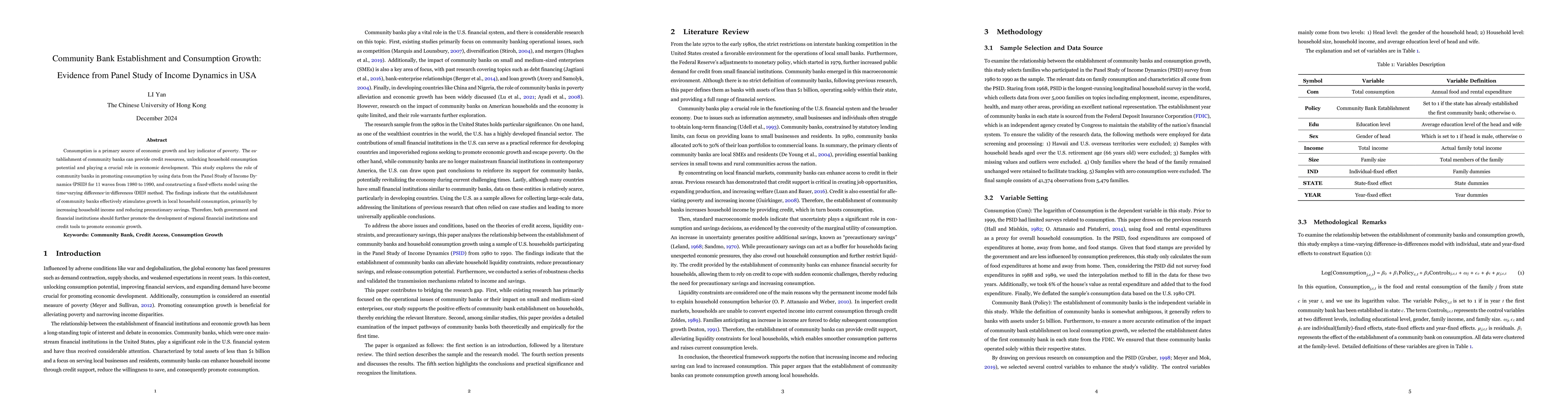

Consumption is a primary source of economic growth and key indicator of poverty. The establishment of community banks can provide credit resources, unlocking household consumption potential and playing a crucial role in economic development. This study explores the role of community banks in promoting consumption by using data from the Panel Study of Income Dynamics (PSID) for 11 waves from 1980 to 1990, and constructing a fixed-effects model using the time-varying difference-in-differences (DID) method. The findings indicate that the establishment of community banks effectively stimulates growth in local household consumption, primarily by increasing household income and reducing precautionary savings. Therefore, both government and financial institutions should further promote the development of regional financial institutions and credit tools to promote economic growth.

AI Key Findings

Generated Jun 11, 2025

Methodology

The study uses a fixed-effects model with the time-varying difference-in-differences (DID) method, analyzing data from the Panel Study of Income Dynamics (PSID) for 11 waves from 1980 to 1990.

Key Results

- Community bank establishment significantly promotes local household consumption growth.

- The annual food expenditure of households in the state increases by an average of 3.9% following the establishment of community banks.

- Robustness tests, including parallel trends and placebo tests, confirm that the consumption growth is driven by community bank establishment rather than pre-existing trends or concurrent events.

Significance

This research highlights the critical role of community banks in enhancing economic activity within regions, suggesting policies to promote their development for economic growth and poverty alleviation.

Technical Contribution

The study employs a robust econometric approach using PSID data to establish a causal relationship between community bank establishment and household consumption growth.

Novelty

This research adds to existing literature by providing empirical evidence on the role of community banks in promoting consumption growth, particularly through increased household income and reduced precautionary savings.

Limitations

- The period of community bank establishment coincides with the U.S. savings and loan crisis, which may impact the accuracy of conclusions.

- Lack of a unified definition for community banks complicates the identification of the first community bank in various regions.

Future Work

- Explore the impacts of community bank closures and mergers on consumption.

- Investigate community banks' effects on poverty alleviation and other household economic indicators in developing countries.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEvidence for the exponential distribution of income in the USA

Victor M. Yakovenko, Adrian Dragulescu

No citations found for this paper.

Comments (0)