Authors

Summary

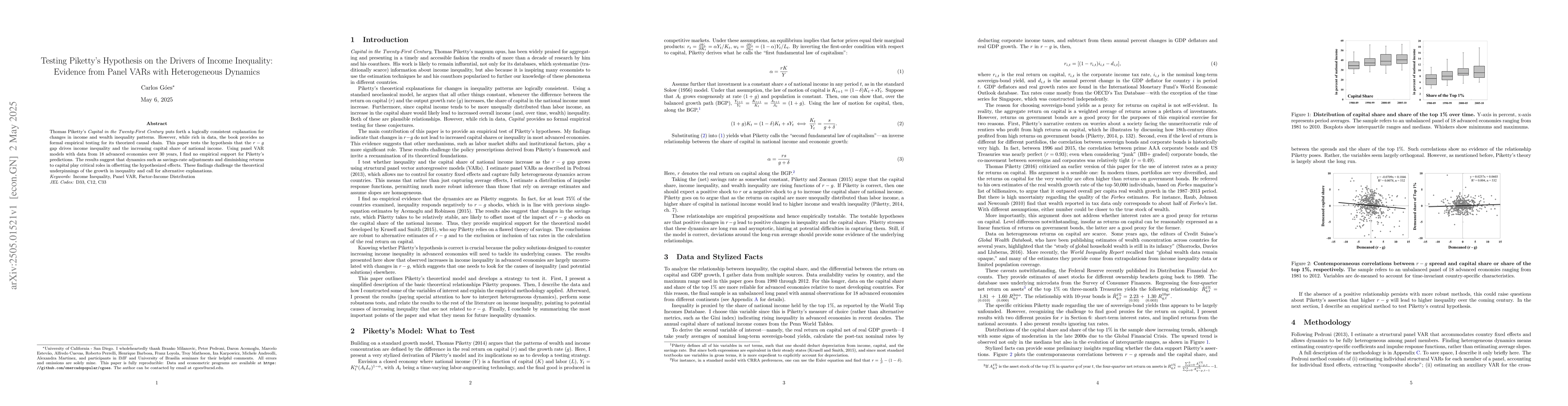

Thomas Piketty's Capital in the Twenty-First Century puts forth a logically consistent explanation for changes in income and wealth inequality patterns. However, while rich in data, the book provides no formal empirical testing for its theorized causal chain. This paper tests the hypothesis that the $r-g$ gap drives income inequality and the increasing capital share of national income. Using panel VAR models with data from 18 advanced economies over 30 years, I find no empirical support for Piketty's predictions. The results suggest that dynamics such as savings-rate adjustments and diminishing returns to capital play critical roles in offsetting the hypothesized effects. These findings challenge the theoretical underpinnings of the growth in inequality and call for alternative explanations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe implications of institutional specificities on the income inequalities drivers in European Union

Dynamic Heterogeneous Distribution Regression Panel Models, with an Application to Labor Income Processes

Yuan Liao, Wayne Yuan Gao, Francis Vella et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)