Summary

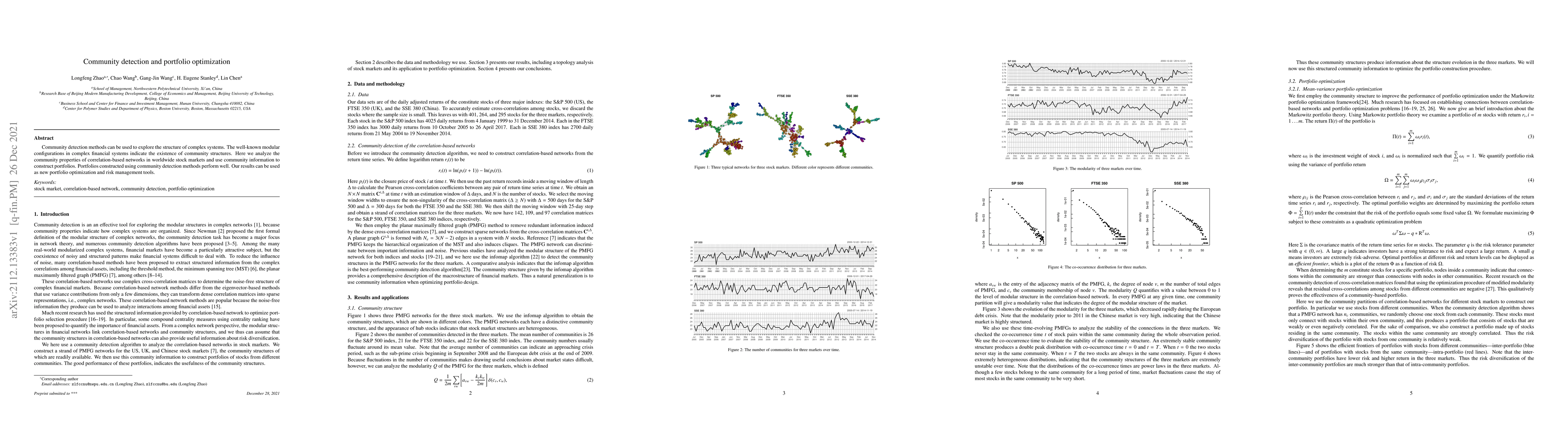

Community detection methods can be used to explore the structure of complex systems. The well-known modular configurations in complex financial systems indicate the existence of community structures. Here we analyze the community properties of correlation-based networks in worldwide stock markets and use community information to construct portfolios. Portfolios constructed using community detection methods perform well. Our results can be used as new portfolio optimization and risk management tools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)