Summary

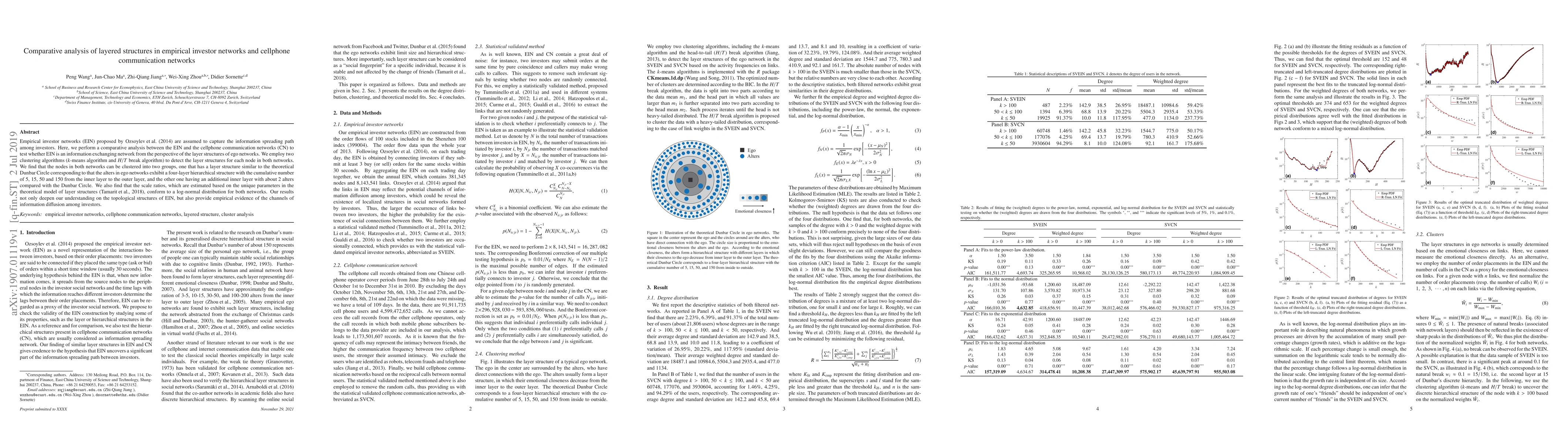

Empirical investor networks (EIN) proposed by \cite{Ozsoylev-Walden-Yavuz-Bildik-2014-RFS} are assumed to capture the information spreading path among investors. Here, we perform a comparative analysis between the EIN and the cellphone communication networks (CN) to test whether EIN is an information exchanging network from the perspective of the layer structures of ego networks. We employ two clustering algorithms ($k$-means algorithm and $H/T$ break algorithm) to detect the layer structures for each node in both networks. We find that the nodes in both networks can be clustered into two groups, one that has a layer structure similar to the theoretical Dunbar Circle corresponding to that the alters in ego networks exhibit a four-layer hierarchical structure with the cumulative number of 5, 15, 50 and 150 from the inner layer to the outer layer, and the other one having an additional inner layer with about 2 alters compared with the Dunbar Circle. We also find that the scale ratios, which are estimated based on the unique parameters in the theoretical model of layer structures \citep{Tamarit-Cuesta-Dunbar-Sanchez-2018-PNAS}, conform to a log-normal distribution for both networks. Our results not only deepen our understanding on the topological structures of EIN, but also provide empirical evidence of the channels of information diffusion among investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)