Summary

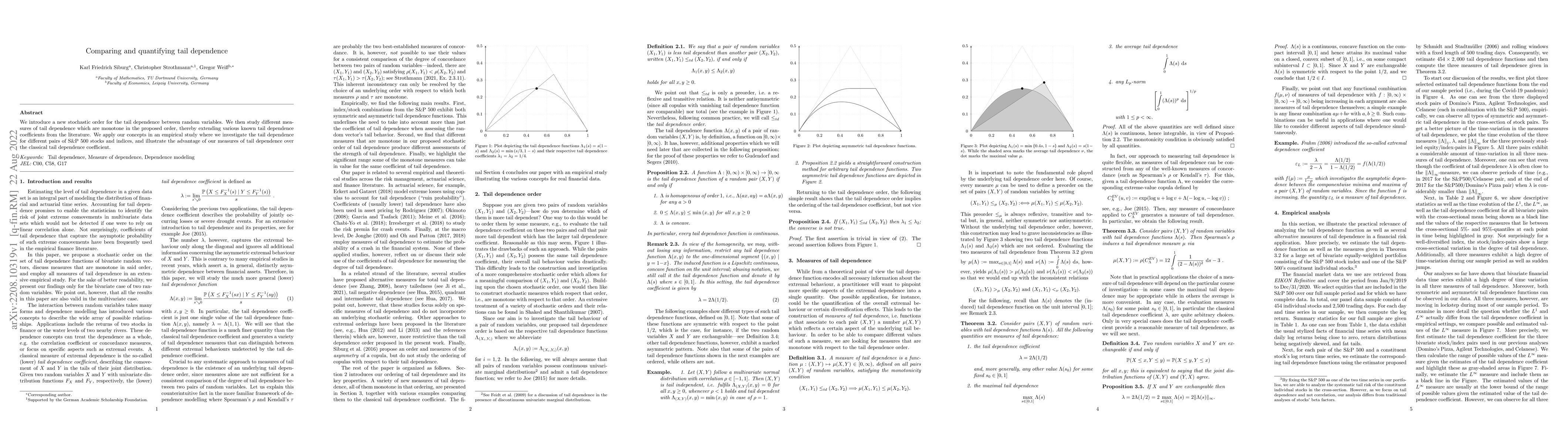

We introduce a new stochastic order for the tail dependence between random variables. We then study different measures of tail dependence which are monotone in the proposed order, thereby extending various known tail dependence coefficients from the literature. We apply our concepts in an empirical study where we investigate the tail dependence for different pairs of S&P 500 stocks and indices, and illustrate the advantage of our measures of tail dependence over the classical tail dependence coefficient.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasuring non-exchangeable tail dependence using tail copulas

Takaaki Koike, Marius Hofert, Shogo Kato

| Title | Authors | Year | Actions |

|---|

Comments (0)