Authors

Summary

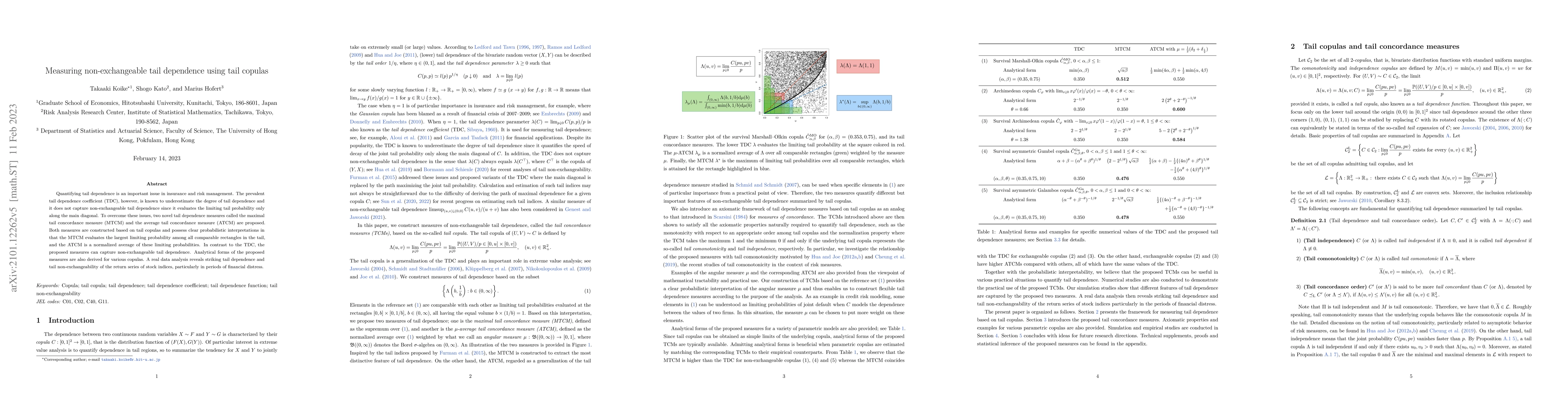

Quantifying tail dependence is an important issue in insurance and risk management. The prevalent tail dependence coefficient (TDC), however, is known to underestimate the degree of tail dependence and it does not capture non-exchangeable tail dependence since it evaluates the limiting tail probability only along the main diagonal. To overcome these issues, two novel tail dependence measures called the maximal tail concordance measure (MTCM) and the average tail concordance measure (ATCM) are proposed. Both measures are constructed based on tail copulas and possess clear probabilistic interpretations in that the MTCM evaluates the largest limiting probability among all comparable rectangles in the tail, and the ATCM is a normalized average of these limiting probabilities. In contrast to the TDC, the proposed measures can capture non-exchangeable tail dependence. Analytical forms of the proposed measures are also derived for various copulas. A real data analysis reveals striking tail dependence and tail non-exchangeability of the return series of stock indices, particularly in periods of financial distress.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian nonparametric copulas with tail dependence

Maria Concepción Ausín, Maria Kalli

A geometric investigation into the tail dependence of vine copulas

Jonathan A. Tawn, Emma S. Simpson, Jennifer L. Wadsworth

| Title | Authors | Year | Actions |

|---|

Comments (0)