Takaaki Koike

10 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Tail risk forecasting with semi-parametric regression models by incorporating overnight information

This research incorporates realized volatility and overnight information into risk models, wherein the overnight return often contributes significantly to the total return volatility. Extending a se...

Forecasting and Backtesting Gradient Allocations of Expected Shortfall

Capital allocation is a procedure for quantifying the contribution of each source of risk to aggregated risk. The gradient allocation rule, also known as the Euler principle, is a prevalent rule of ...

Invariant correlation under marginal transforms

A useful property of independent samples is that their correlation remains the same after applying marginal transforms. This invariance property plays a fundamental role in statistical inference, bu...

Joint mixability and notions of negative dependence

A joint mix is a random vector with a constant component-wise sum. The dependence structure of a joint mix minimizes some common objectives such as the variance of the component-wise sum, and it is ...

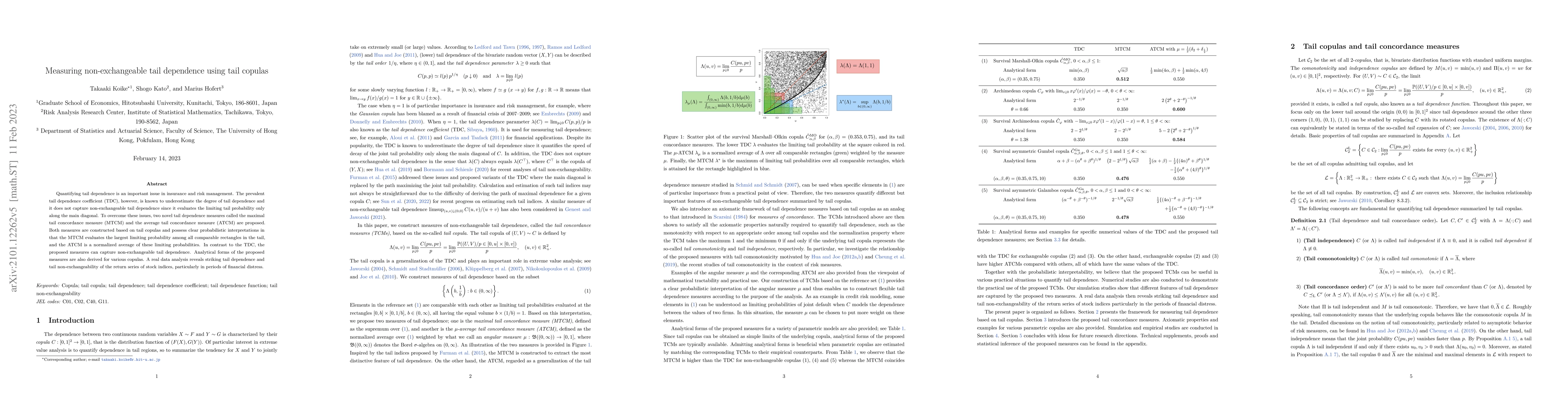

Measuring non-exchangeable tail dependence using tail copulas

Quantifying tail dependence is an important issue in insurance and risk management. The prevalent tail dependence coefficient (TDC), however, is known to underestimate the degree of tail dependence ...

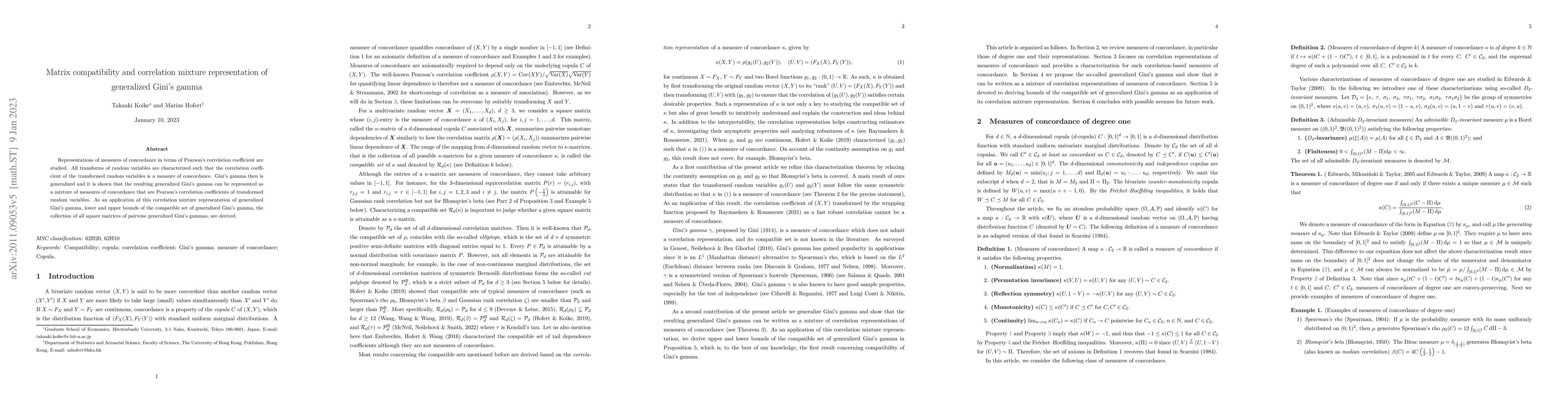

Matrix compatibility and correlation mixture representation of generalized Gini's gamma

Representations of measures of concordance in terms of Pearson' s correlation coefficient are studied. All transforms of random variables are characterized such that the correlation coefficient of t...

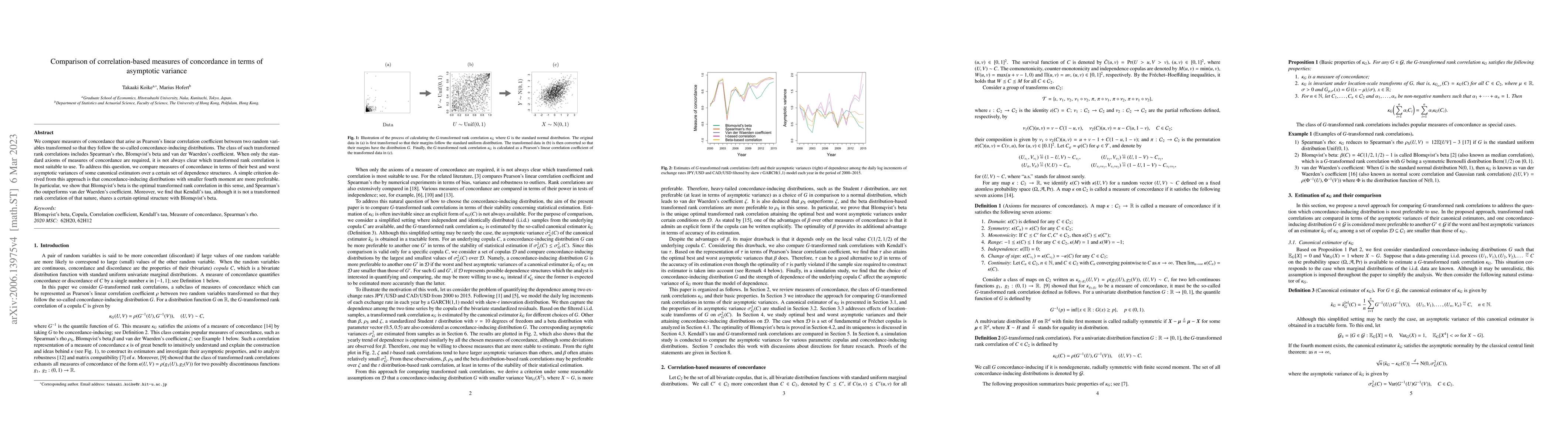

Comparison of correlation-based measures of concordance in terms of asymptotic variance

We compare measures of concordance that arise as Pearson's linear correlation coefficient between two random variables transformed so that they follow the so-called concordance-inducing distribution...

Avoiding zero probability events when computing Value at Risk contributions

This paper is concerned with the process of risk allocation for a generic multivariate model when the risk measure is chosen as the Value-at-Risk (VaR). We recast the traditional Euler contributions...

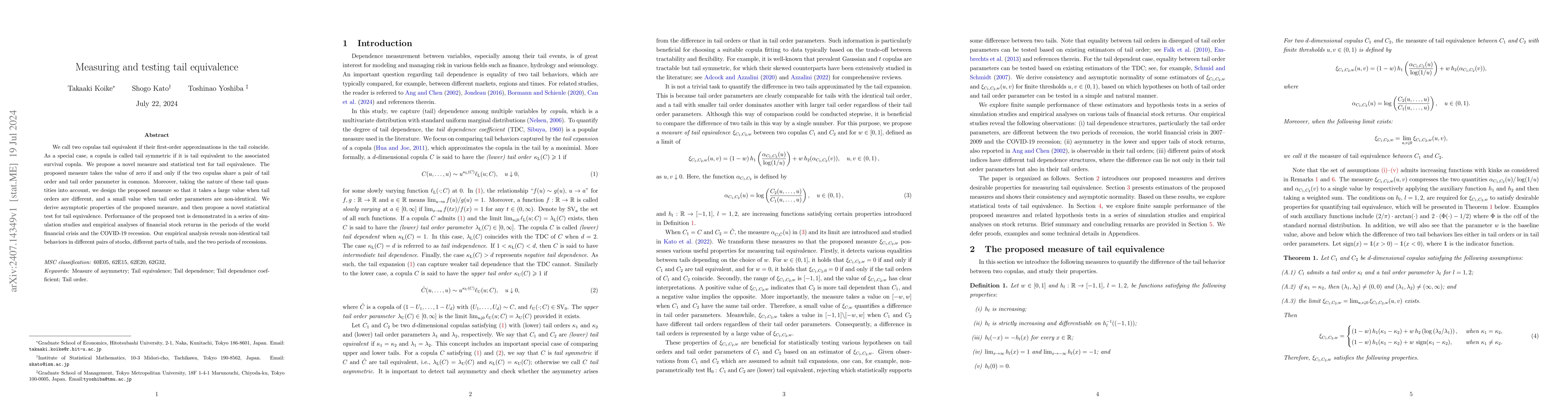

Measuring and testing tail equivalence

We call two copulas tail equivalent if their first-order approximations in the tail coincide. As a special case, a copula is called tail symmetric if it is tail equivalent to the associated survival c...

Robust risk evaluation of joint life insurance under dependence uncertainty

Dependence among multiple lifetimes is a key factor for pricing and evaluating the risk of joint life insurance products. The dependence structure can be exposed to model uncertainty when available da...