Authors

Summary

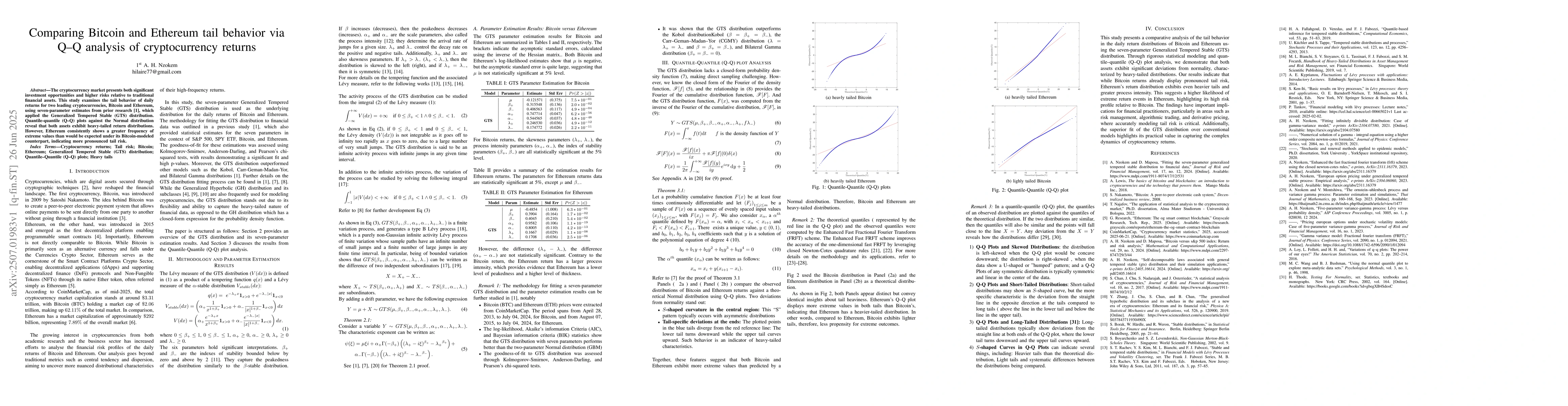

The cryptocurrency market presents both significant investment opportunities and higher risks relative to traditional financial assets. This study examines the tail behavior of daily returns for two leading cryptocurrencies, Bitcoin and Ethereum, using seven-parameter estimates from prior research, which applied the Generalized Tempered Stable (GTS) distribution. Quantile-quantile (Q-Q) plots against the Normal distribution reveal that both assets exhibit heavy-tailed return distributions. However, Ethereum consistently shows a greater frequency of extreme values than would be expected under its Bitcoin-modeled counterpart, indicating more pronounced tail risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDimensionality reduction for prediction: Application to Bitcoin and Ethereum

Hugo Inzirillo, Benjamin Mat

No citations found for this paper.

Comments (0)