Summary

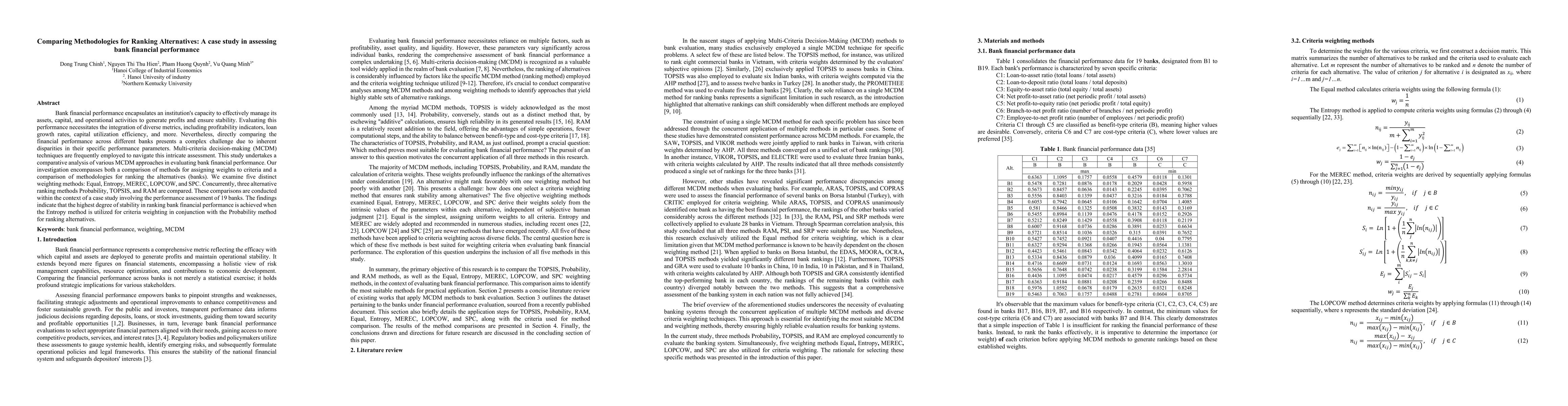

Bank financial performance encapsulates an institution's capacity to effectively manage its assets, capital, and operational activities to generate profits and ensure stability. Evaluating this performance necessitates the integration of diverse metrics, including profitability indicators, loan growth rates, capital utilization efficiency, and more. Nevertheless, directly comparing the financial performance across different banks presents a complex challenge due to inherent disparities in their specific performance parameters. Multi-criteria decision-making (MCDM) techniques are frequently employed to navigate this intricate assessment. This study undertakes a comparative analysis of various MCDM approaches in evaluating bank financial performance. Our investigation encompasses both a comparison of methods for assigning weights to criteria and a comparison of methodologies for ranking the alternatives (banks). We examine five distinct weighting methods: Equal, Entropy, MEREC, LOPCOW, and SPC. Concurrently, three alternative ranking methods Probability, TOPSIS, and RAM are compared. These comparisons are conducted within the context of a case study involving the performance assessment of 19 banks. The findings indicate that the highest degree of stability in ranking bank financial performance is achieved when the Entropy method is utilized for criteria weighting in conjunction with the Probability method for ranking alternatives.

AI Key Findings

Generated Nov 01, 2025

Methodology

The study compared five objective weighting methods (Equal, Entropy, MEREC, LOPCOW, SPC) and three ranking methods (Probability, TOPSIS, RAM) to evaluate bank financial performance. Criteria weights were calculated using these methods, and alternative rankings were generated to assess stability.

Key Results

- Entropy and SPC methods show inverse relationship in criterion weighting

- Top 4 and bottom 2 banks maintain rankings across all methods

- Probability method provides highest ranking stability

Significance

This research helps financial institutions and regulators make data-driven decisions by providing stable performance evaluations, promoting transparency and healthy competition in banking sector.

Technical Contribution

Developed a comprehensive framework for evaluating multi-criteria decision making methods in financial performance assessment

Novelty

First study to systematically compare both weighting and ranking methods' impact on stability in banking performance evaluation

Limitations

- Excludes subjective expert opinions in weighting

- Limited to specific banking dataset

Future Work

- Incorporate subjective weighting methods like SIWEC and PIPRECIA

- Expand analysis to different financial sectors

Paper Details

PDF Preview

Similar Papers

Found 4 papersAssessing the physical risks of climate change for the financial sector: a case study from Mexico's Central Bank

Francisco Estrada, Miguel A. Altamirano del Carmen, Oscar Calderon-Bustamante et al.

The Ranking Problem of Alternatives as a Cooperative Game

Aleksei Kondratev, Vladimir Mazalov

Comments (0)