Authors

Summary

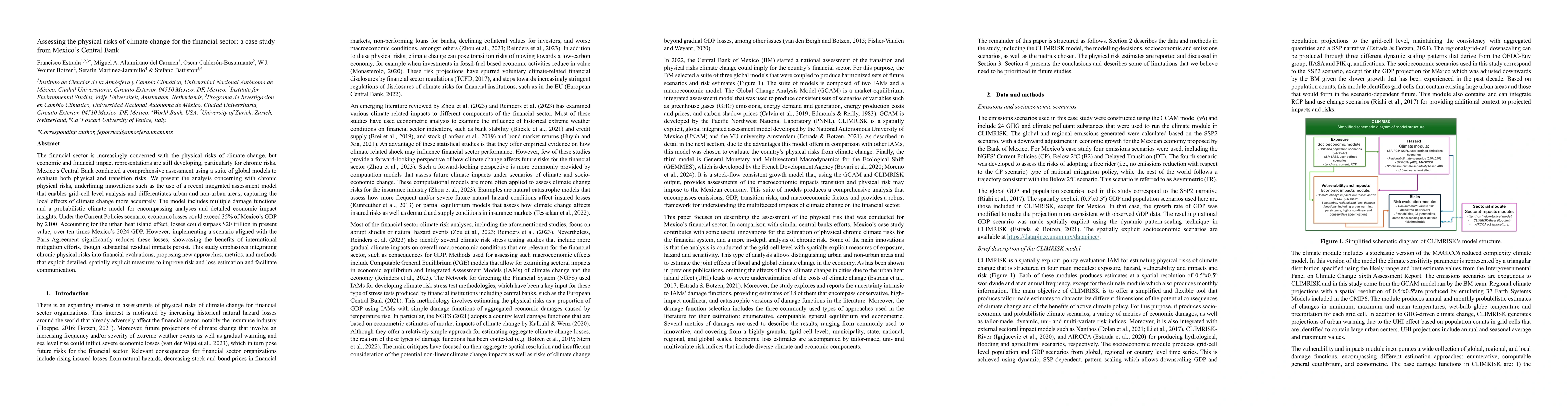

The financial sector is increasingly concerned with the physical risks of climate change, but economic and financial impact representations are still developing, particularly for chronic risks. Mexico's Central Bank conducted a comprehensive assessment using a suite of global models to evaluate both physical and transition risks. We present the analysis concerning with chronic physical risks, underlining innovations such as the use of a recent integrated assessment model that enables grid-cell level analysis and differentiates urban and non-urban areas, capturing the local effects of climate change more accurately. The model includes multiple damage functions and a probabilistic climate model for encompassing analyses and detailed economic impact insights. Under the Current Policies scenario, economic losses could exceed 35 percent of Mexico's GDP by 2100. Accounting for the urban heat island effect, losses could surpass 20 trillion (USD) in present value, over ten times Mexico's 2024 GDP. However, implementing a scenario aligned with the Paris Agreement significantly reduces these losses, showcasing the benefits of international mitigation efforts, though substantial residual impacts persist. This study emphasizes integrating chronic physical risks into financial evaluations, proposing new approaches, metrics, and methods that exploit detailed, spatially explicit measures to improve risk and loss estimation and facilitate communication.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersAssessing Climate Transition Risks in the Colombian Processed Food Sector: A Fuzzy Logic and Multicriteria Decision-Making Approach

Fabio Caraffini, Juan F. Pérez-Pérez, Pablo Isaza Gómez et al.

No citations found for this paper.

Comments (0)