Summary

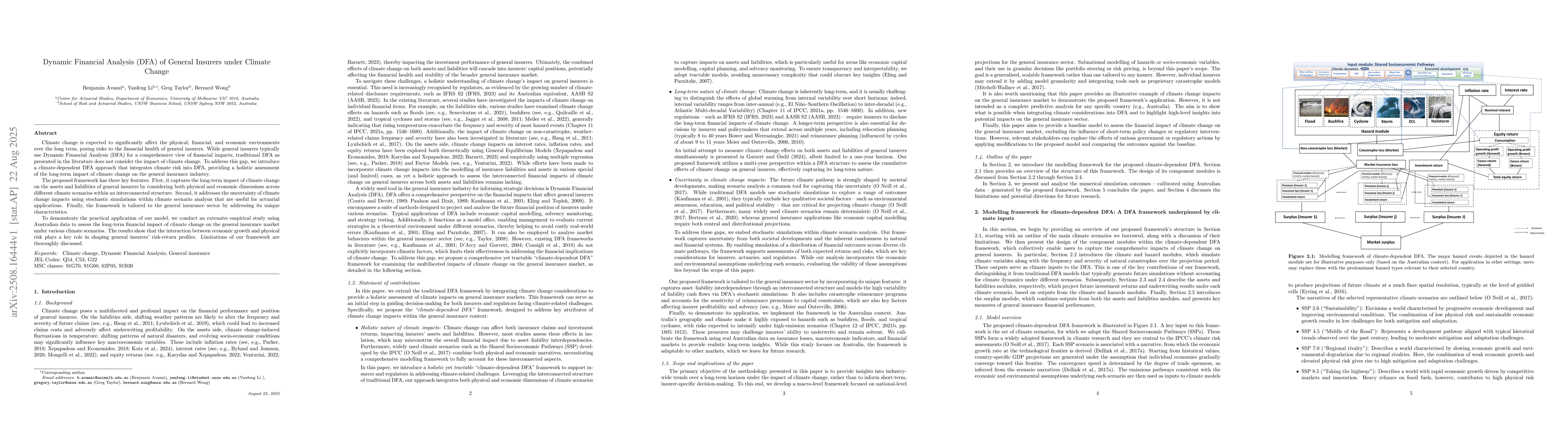

Climate change is expected to significantly affect the physical, financial, and economic environments over the long term, posing risks to the financial health of general insurers. While general insurers typically use Dynamic Financial Analysis (DFA) for a comprehensive view of financial impacts, traditional DFA as presented in the literature does not consider the impact of climate change. To address this gap, we introduce a climate-dependent DFA approach that integrates climate risk into DFA, providing a holistic assessment of the long-term impact of climate change on the general insurance industry. The proposed framework has three key features. First, it captures the long-term impact of climate change on the assets and liabilities of general insurers by considering both physical and economic dimensions across different climate scenarios within an interconnected structure. Second, it addresses the uncertainty of climate change impacts using stochastic simulations within climate scenario analysis that are useful for actuarial applications. Finally, the framework is tailored to the general insurance sector by addressing its unique characteristics. To demonstrate the practical application of our model, we conduct an extensive empirical study using Australian data to assess the long-term financial impact of climate change on the general insurance market under various climate scenarios. The results show that the interaction between economic growth and physical risk plays a key role in shaping general insurers' risk-return profiles. Limitations of our framework are thoroughly discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersA Novel Dynamic Bias-Correction Framework for Hurricane Risk Assessment under Climate Change

Teng Wu, Reda Snaiki

Radiatively-Cooled Moist Convection under an Idealised Climate Change Scenario: Linear Analysis

Steven M. Tobias, Gregory N. Dritschel, Douglas J. Parker et al.

Comments (0)