Summary

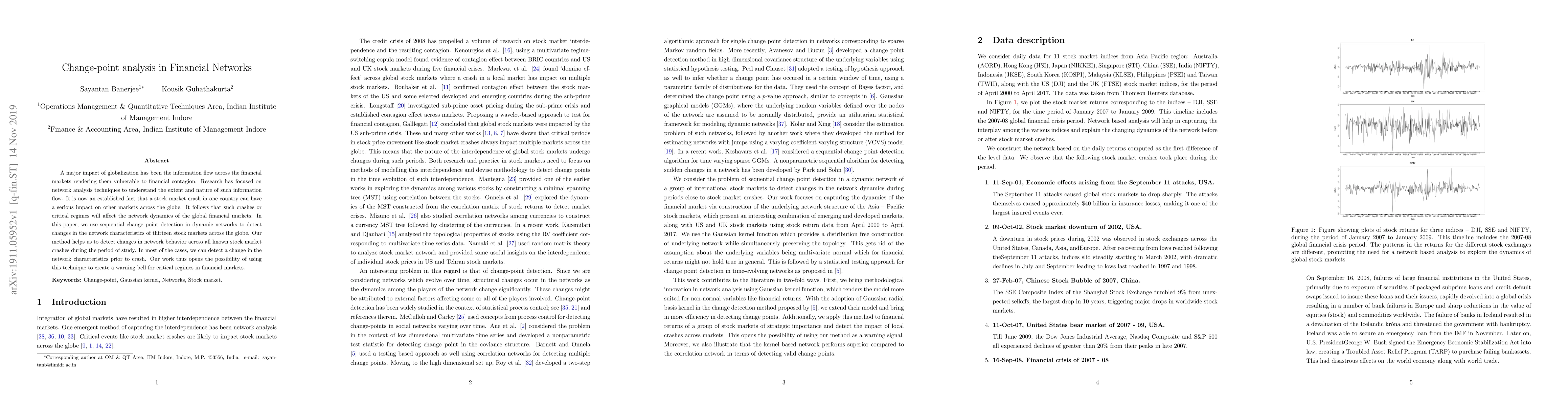

A major impact of globalization has been the information flow across the financial markets rendering them vulnerable to financial contagion. Research has focused on network analysis techniques to understand the extent and nature of such information flow. It is now an established fact that a stock market crash in one country can have a serious impact on other markets across the globe. It follows that such crashes or critical regimes will affect the network dynamics of the global financial markets. In this paper, we use sequential change point detection in dynamic networks to detect changes in the network characteristics of thirteen stock markets across the globe. Our method helps us to detect changes in network behavior across all known stock market crashes during the period of study. In most of the cases, we can detect a change in the network characteristics prior to crash. Our work thus opens the possibility of using this technique to create a warning bell for critical regimes in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)