Authors

Summary

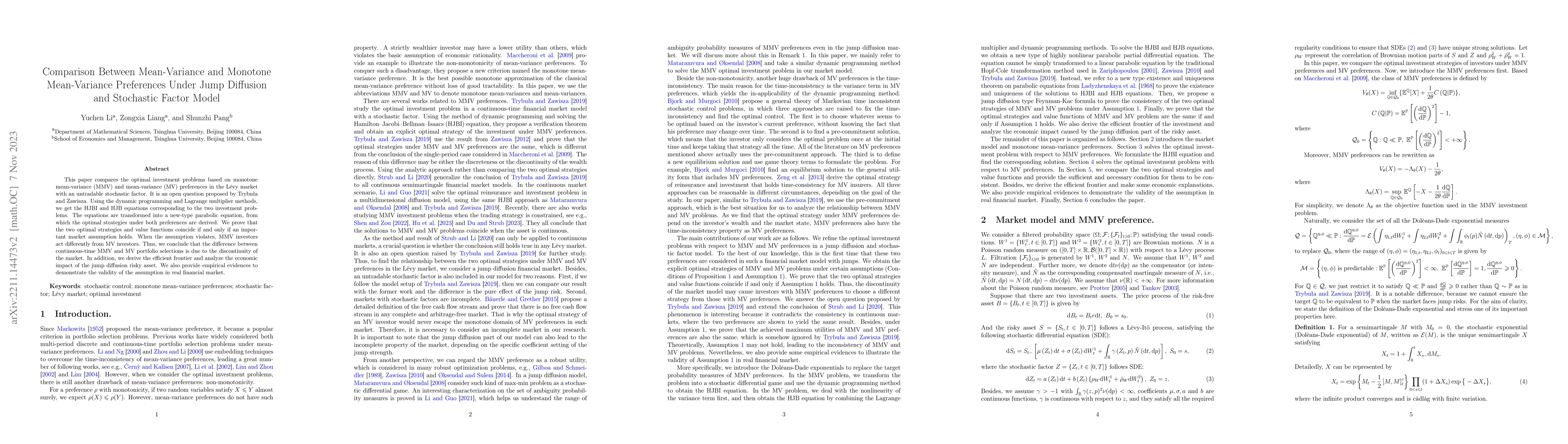

This paper compares the optimal investment problems based on monotone mean-variance (MMV) and mean-variance (MV) preferences in the L\'{e}vy market with an untradable stochastic factor. It is an open question proposed by Trybu{\l}a and Zawisza. Using the dynamic programming and Lagrange multiplier methods, we get the HJBI and HJB equations corresponding to the two investment problems. The equations are transformed into a new-type parabolic equation, from which the optimal strategies under both preferences are derived. We prove that the two optimal strategies and value functions coincide if and only if an important market assumption holds. When the assumption violates, MMV investors act differently from MV investors. Thus, we conclude that the difference between continuous-time MMV and MV portfolio selections is due to the discontinuity of the market. In addition, we derive the efficient frontier and analyze the economic impact of the jump diffusion risky asset. We also provide empirical evidences to demonstrate the validity of the assumption in real financial market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContinuous-Time Portfolio Choice Under Monotone Mean-Variance Preferences-Stochastic Factor Case

Jakub Trybuła, Dariusz Zawisza

Continuous-Time Monotone Mean-Variance Portfolio Selection in Jump-Diffusion Model

Yuchen Li, Zongxia Liang, Shunzhi Pang

Cone-constrained Monotone Mean-Variance Portfolio Selection Under Diffusion Models

Yang Shen, Bin Zou

Strictly monotone mean-variance preferences with dynamic portfolio management

Yike Wang, Yusha Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)