Authors

Summary

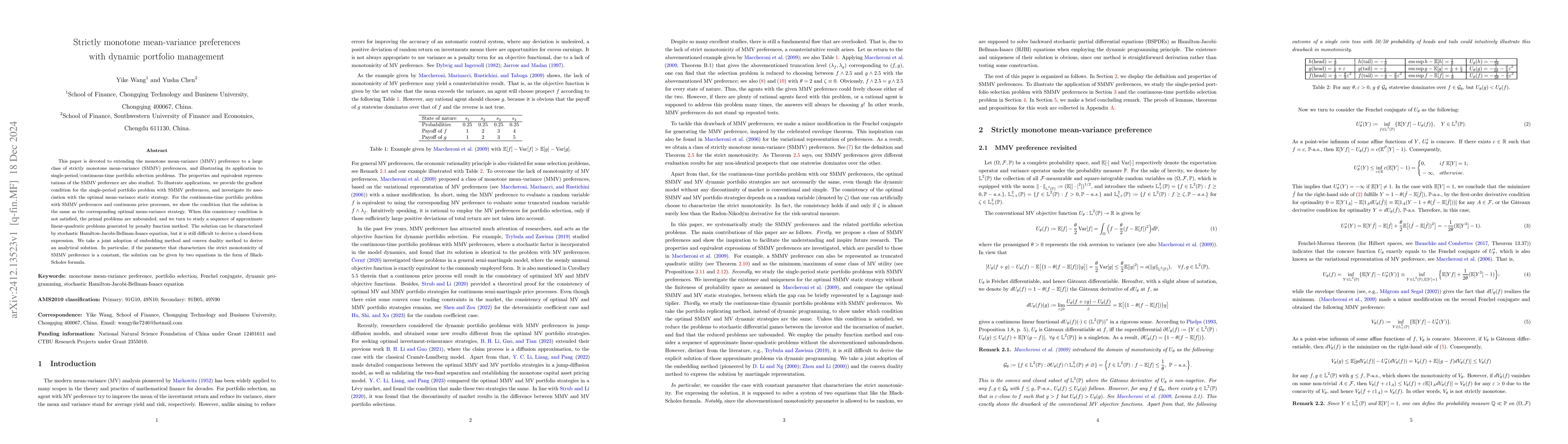

This paper is devoted to extending the monotone mean-variance (MMV) preference to a large class of strictly monotone mean-variance (SMMV) preferences, and illustrating its application to single-period/continuous-time portfolio selection problems. The properties and equivalent representations of the SMMV preference are also studied. To illustrate applications, we provide the gradient condition for the single-period portfolio problem with SMMV preferences, and investigate its association with the optimal mean-variance static strategy. For the continuous-time portfolio problem with SMMV preferences and continuous price processes, we show the condition that the solution is the same as the corresponding optimal mean-variance strategy. When this consistency condition is not satisfied, the primal problems are unbounded, and we turn to study a sequence of approximate linear-quadratic problems generated by penalty function method. The solution can be characterized by stochastic Hamilton-Jacobi-Bellman-Isaacs equation, but it is still difficult to derive a closed-form expression. We take a joint adoption of embedding method and convex duality method to derive an analytical solution. In particular, if the parameter that characterizes the strict monotonicity of SMMV preference is a constant, the solution can be given by two equations in the form of Black-Scholes formula.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersTime-consistent portfolio selection with strictly monotone mean-variance preference

Yike Wang, Yusha Chen

Continuous-Time Portfolio Choice Under Monotone Mean-Variance Preferences-Stochastic Factor Case

Jakub Trybuła, Dariusz Zawisza

No citations found for this paper.

Comments (0)