Summary

We study dynamic optimal portfolio allocation for monotone mean--variance preferences in a general semimartingale model. Armed with new results in this area we revisit the work of Cui, Li, Wang and Zhu (2012, MAFI) and fully characterize the circumstances under which one can set aside a non-negative cash flow while simultaneously improving the mean--variance efficiency of the left-over wealth. The paper analyzes, for the first time, the monotone hull of the Sharpe ratio and highlights its relevance to the problem at hand.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

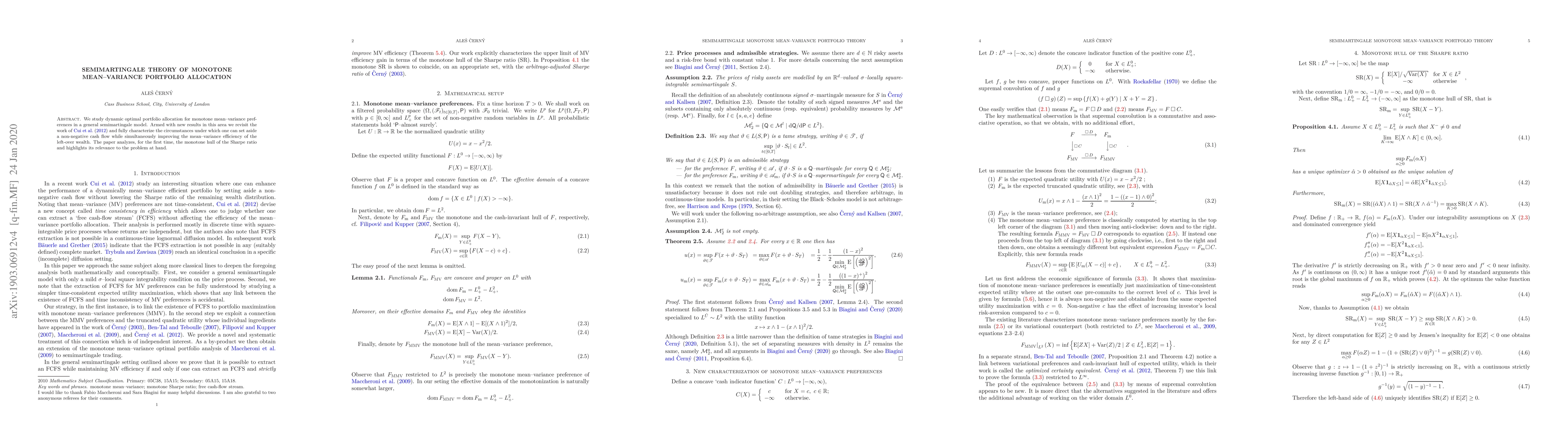

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMonotone Mean-Variance Portfolio Selection in Semimartingale Markets: Martingale Method

Yuchen Li, Zongxia Liang, Shunzhi Pang

Strictly monotone mean-variance preferences with dynamic portfolio management

Yike Wang, Yusha Chen

Cone-constrained Monotone Mean-Variance Portfolio Selection Under Diffusion Models

Yang Shen, Bin Zou

Time-consistent portfolio selection with strictly monotone mean-variance preference

Yike Wang, Yusha Chen

| Title | Authors | Year | Actions |

|---|

Comments (0)