Summary

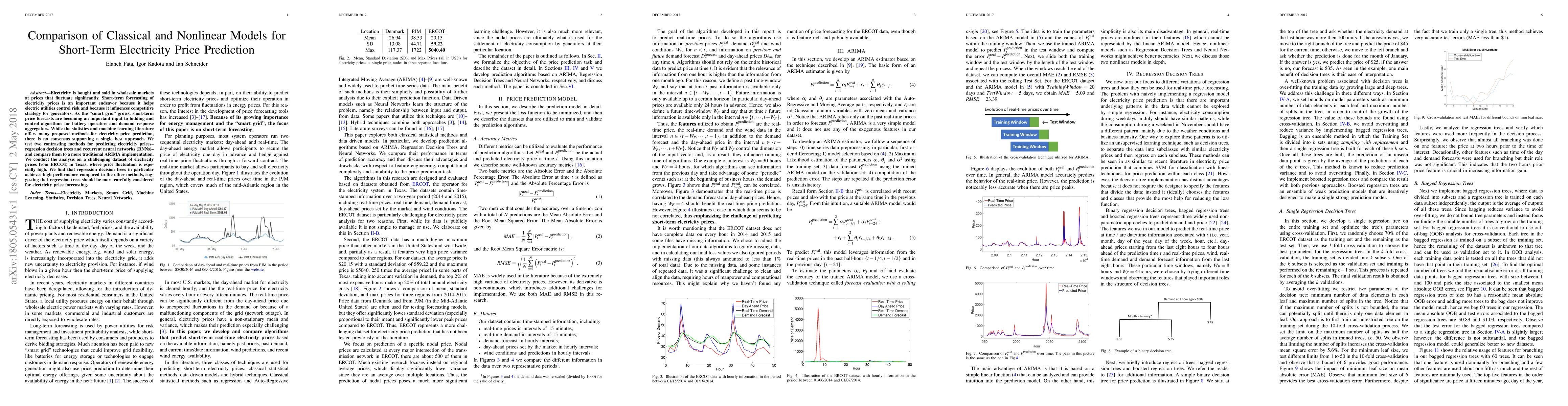

Electricity is bought and sold in wholesale markets at prices that fluctuate significantly. Short-term forecasting of electricity prices is an important endeavor because it helps electric utilities control risk and because it influences competitive strategy for generators. As the "smart grid" grows, short-term price forecasts are becoming an important input to bidding and control algorithms for battery operators and demand response aggregators. While the statistics and machine learning literature offers many proposed methods for electricity price prediction, there is no consensus supporting a single best approach. We test two contrasting machine learning approaches for predicting electricity prices, regression decision trees and recurrent neural networks (RNNs), and compare them to a more traditional ARIMA implementation. We conduct the analysis on a challenging dataset of electricity prices from ERCOT, in Texas, where price fluctuation is especially high. We find that regression decision trees in particular achieves high performance compared to the other methods, suggesting that regression trees should be more carefully considered for electricity price forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShort-term Prediction of Household Electricity Consumption Using Customized LSTM and GRU Models

Rasha Kashef, Saad Emshagin, Wayes Koroni Halim

| Title | Authors | Year | Actions |

|---|

Comments (0)