Authors

Summary

Conditional risk measures and their associated risk contribution measures are commonly employed in finance and actuarial science for evaluating systemic risk and quantifying the effects of risk contagion. This paper introduces various types of contribution measures based on the MCoVaR, MCoES, and MMME studied in Ortega-Jim\'enez et al. (2021) and Das & Fasen-Hartmann (2018) to assess both the absolute and relative effects of a single risk when other risks in a group are in distress. The properties of these contribution risk measures are examined, and sufficient conditions for comparing these measures between two sets of random vectors are established using univariate and multivariate stochastic orders and stochastic dependence notions. Numerical examples are presented for validating the conditions. Finally, a real dataset from the cryptocurrency market is also utilized to analyze the contagion effect in terms of our proposed contribution measures.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

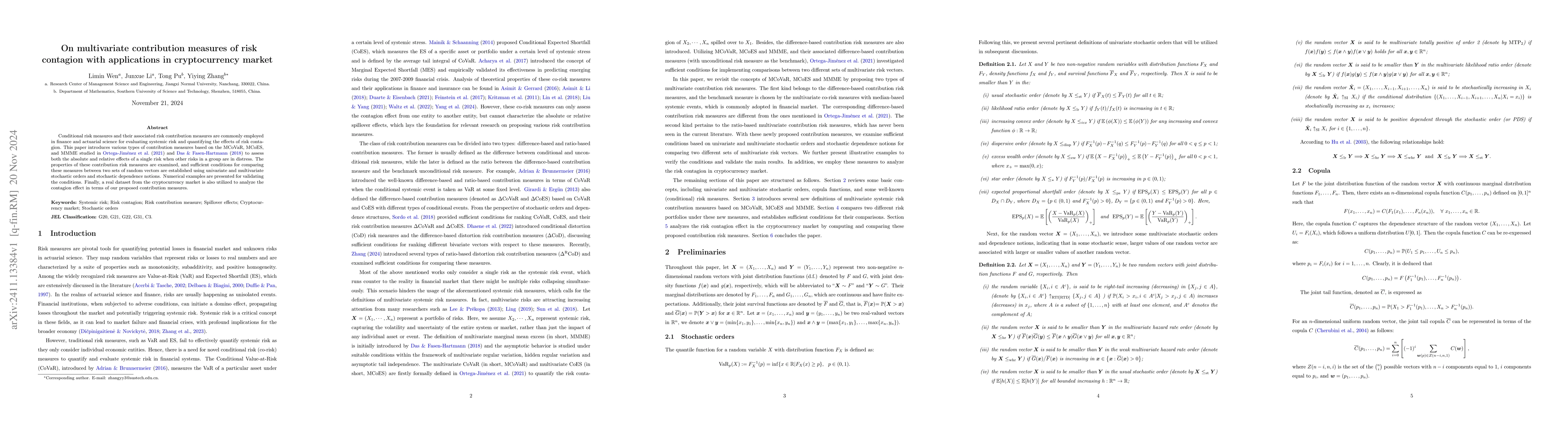

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOn Vulnerability Conditional Risk Measures: Comparisons and Applications in Cryptocurrency Market

Yiying Zhang, Tong Pu, Yunran Wei

On Joint Marginal Expected Shortfall and Associated Contribution Risk Measures

Yifei Zhang, Yiying Zhang, Tong Pu

Navigating Market Turbulence: Insights from Causal Network Contagion Value at Risk

Ernst C. Wit, Katerina Rigana, Samantha Cook

No citations found for this paper.

Comments (0)