Authors

Summary

We introduce a novel class of systemic risk measures, the Vulnerability Conditional risk measures, which try to capture the "tail risk" of a risky position in scenarios where one or more market participants is experiencing financial distress. Various theoretical properties of Vulnerability Conditional risk measures, along with a series of related contribution measures, have been considered in this paper. We further introduce the backtesting procedures of VCoES and MCoES. Through numerical examples, we validate our theoretical insights and further apply our newly proposed risk measures to the empirical analysis of cryptocurrencies, demonstrating their practical relevance and utility in capturing systemic risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

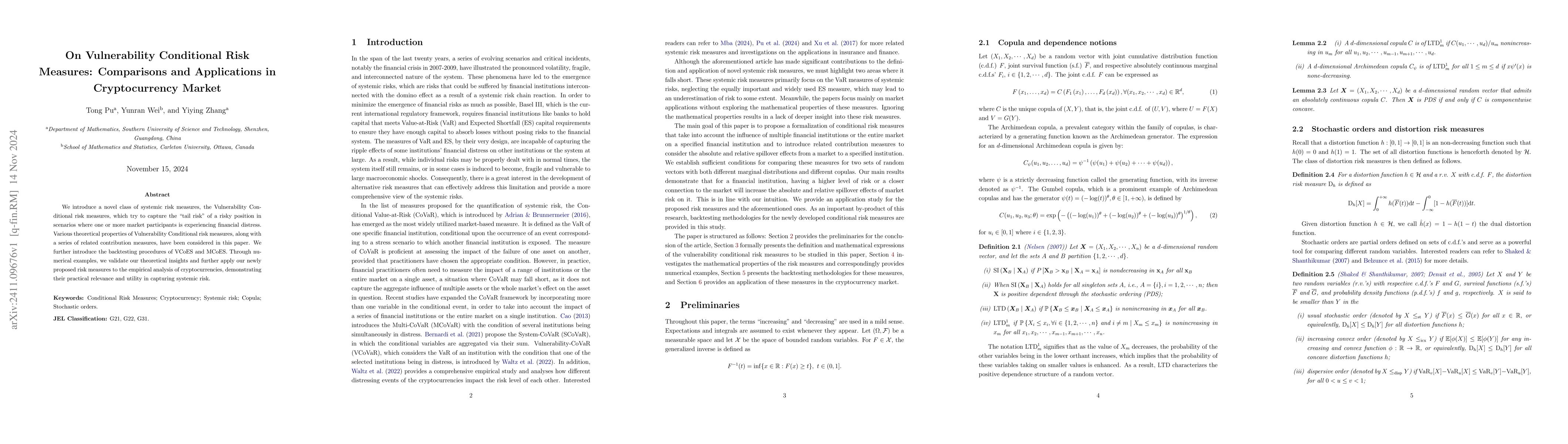

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparisons of multivariate contribution measures of risk contagion and their applications in cryptocurrency market

Yiying Zhang, Tong Pu, Junxue Li et al.

Vulnerability-CoVaR: Investigating the Crypto-market

Ostap Okhrin, Martin Waltz, Abhay Kumar Singh

No citations found for this paper.

Comments (0)