Summary

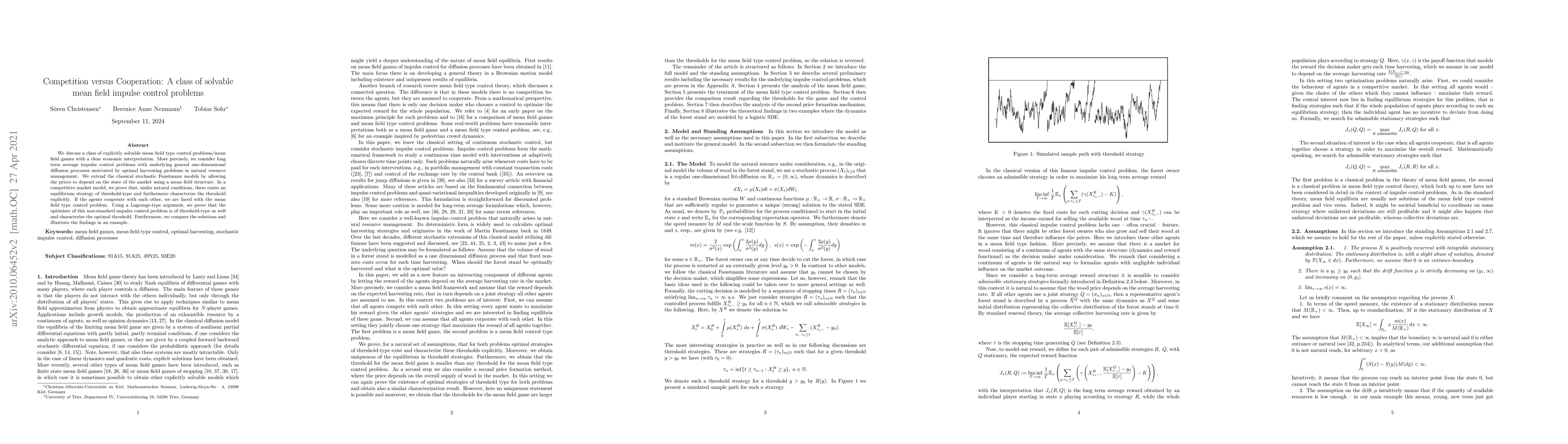

We discuss a class of explicitly solvable mean field type control problems/mean field games with a clear economic interpretation. More precisely, we consider long term average impulse control problems with underlying general one-dimensional diffusion processes motivated by optimal harvesting problems in natural resource management. We extend the classical stochastic Faustmann models by allowing the prices to depend on the state of the market using a mean field structure. In a competitive market model, we prove that, under natural conditions, there exists an equilibrium strategy of threshold-type and furthermore characterize the threshold explicitly. If the agents cooperate with each other, we are faced with the mean field type control problem. Using a Lagrange-type argument, we prove that the optimizer of this non-standard impulse control problem is of threshold-type as well and characterize the optimal threshold. Furthermore, we compare the solutions and illustrate the findings in an example.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMean Field Analysis of Two-Party Governance: Competition versus Cooperation among Leaders

Dantong Chu, Kenneth Tsz Hin Ng, Sheung Chi Phillip Yam et al.

Long-Term Average Impulse Control with Mean Field Interactions

K. L. Helmes, R. H. Stockbridge, C. Zhu

| Title | Authors | Year | Actions |

|---|

Comments (0)