Authors

Summary

This paper analyzes and provides explicit solutions for a long-term average impulse control problem with a specific mean-field interaction. The underlying process is a general one-dimensional diffusion with appropriate boundary behavior. The model is motivated by applications such the optimal long-term management of renewable natural resources and financial portfolio management. Each individual agent seeks to maximize the long-term average reward, which consists of a running reward and incomes from discrete impulses, where the unit intervention price depends on the market through a stationary supply rate. In a competitive market setting, we establish the existence of and explicitly characterize an equilibrium strategy within a large class of policies under mild conditions. Additionally, we formulate and solve the mean field control problem, in which agents cooperate with each other, aiming to realize a common maximal long-term average profit. To illustrate the theoretical results, we examine a stochastic logistic growth model and a population growth model in a stochastic environment with impulse control.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper employs techniques from stochastic control theory and mean-field game theory to analyze long-term average impulse control problems with mean-field interactions, focusing on a general one-dimensional diffusion process with appropriate boundary behavior.

Key Results

- Existence and explicit characterization of an equilibrium strategy for competitive market settings under mild conditions.

- Formulation and solution of the mean-field control problem where agents cooperate to maximize collective long-term average profit.

- Illustration of theoretical results using stochastic logistic growth and population growth models with impulse control.

Significance

This research is important for optimizing long-term management of renewable natural resources and financial portfolio management, providing a theoretical framework that can inform practical decision-making in competitive markets.

Technical Contribution

The paper establishes existence and explicit solutions for long-term average impulse control problems with mean-field interactions, formulates and solves the cooperative mean-field control problem, and validates findings through stochastic growth models.

Novelty

This work differs from existing research by explicitly characterizing equilibrium strategies in competitive markets with mean-field interactions and by extending mean-field game theory to long-term average impulse control problems.

Limitations

- The study assumes a competitive market setting and stationary supply rate, which may not fully capture complexities of real-world markets.

- The analysis is based on one-dimensional diffusion processes; extension to higher dimensions remains an open problem.

Future Work

- Investigate the applicability of the model and results in more complex, non-stationary market environments.

- Explore extensions to higher-dimensional diffusion processes and their implications for resource and financial management.

Paper Details

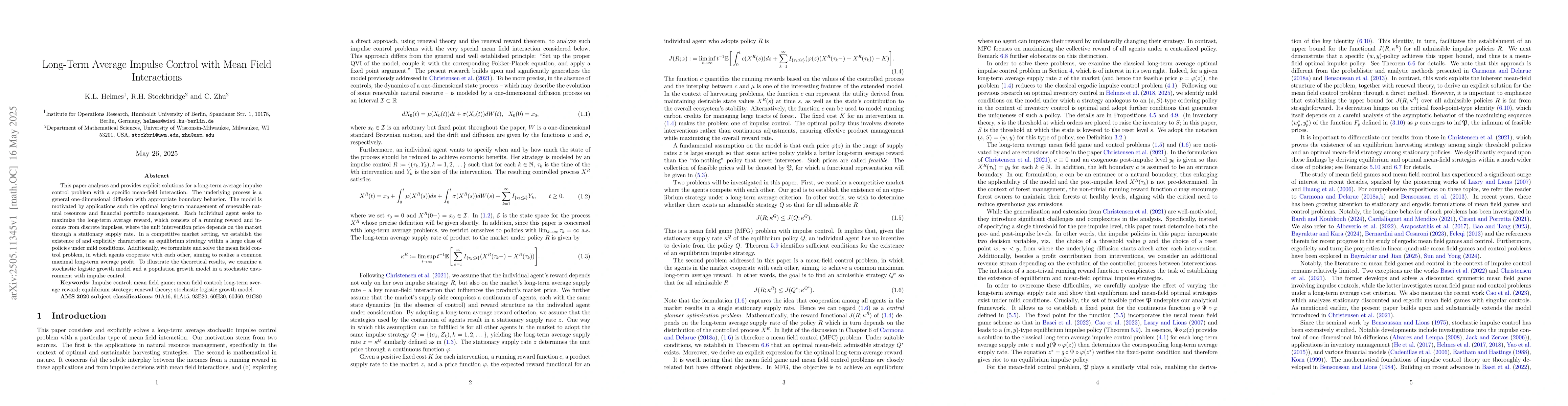

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)