Summary

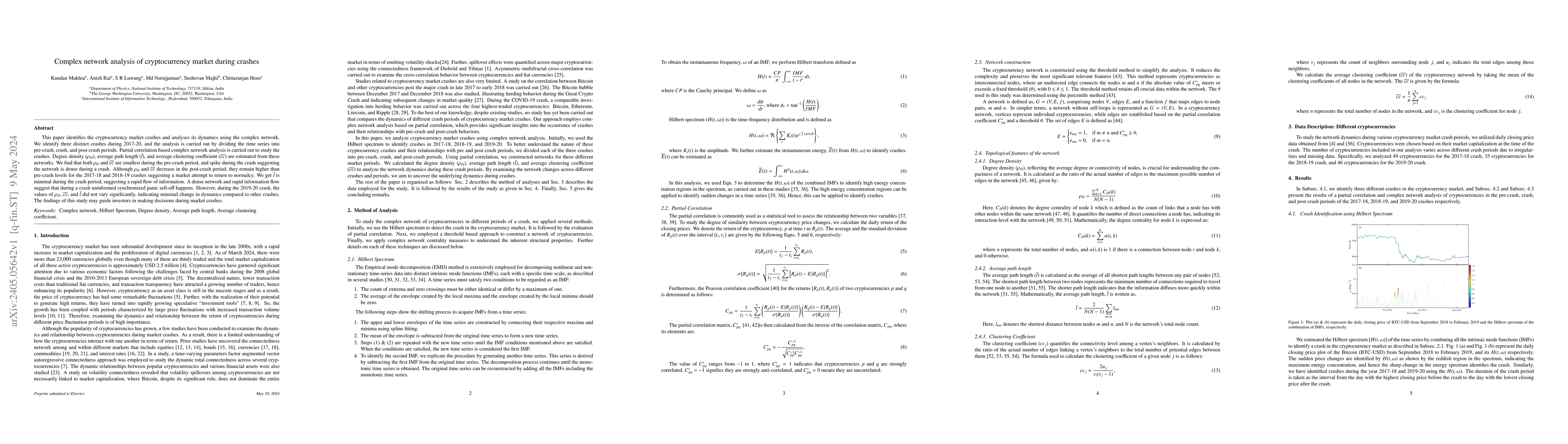

This paper identifies the cryptocurrency market crashes and analyses its dynamics using the complex network. We identify three distinct crashes during 2017-20, and the analysis is carried out by dividing the time series into pre-crash, crash, and post-crash periods. Partial correlation based complex network analysis is carried out to study the crashes. Degree density ($\rho_D$), average path length ($\bar{l}$), and average clustering coefficient ($\overline{cc}$) are estimated from these networks. We find that both $\rho_D$ and $\overline{cc}$ are smallest during the pre-crash period, and spike during the crash suggesting the network is dense during a crash. Although $\rho_D$ and $\overline{cc}$ decrease in the post-crash period, they remain higher than pre-crash levels for the 2017-18 and 2018-19 crashes suggesting a market attempt to return to normalcy. We get $\bar{l}$ is minimal during the crash period, suggesting a rapid flow of information. A dense network and rapid information flow suggest that during a crash uninformed synchronized panic sell-off happens. However, during the 2019-20 crash, the values of $\rho_D$, $\overline{cc}$, and $\bar{l}$ did not vary significantly, indicating minimal change in dynamics compared to other crashes. The findings of this study may guide investors in making decisions during market crashes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersShifting Cryptocurrency Influence: A High-Resolution Network Analysis of Market Leaders

Agam Shah, Sudheer Chava, Vishwa Shah et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)