Summary

Internet finance is a new financial model that applies Internet technology to payment, capital borrowing and lending and transaction processing. In order to study the internal risks, this paper uses the Internet financial risk elements as the network node to construct the complex network of Internet financial risk system. Different from the study of macroeconomic shocks and financial institution data, this paper mainly adopts the perspective of complex system to analyze the systematic risk of Internet finance. By dividing the entire financial system into Internet financial subnet, regulatory subnet and traditional financial subnet, the paper discusses the relationship between contagion and contagion among different risk factors, and concludes that risks are transmitted externally through the internal circulation of Internet finance, thus discovering potential hidden dangers of systemic risks. The results show that the nodes around the center of the whole system are the main objects of financial risk contagion in the Internet financial network. In addition, macro-prudential regulation plays a decisive role in the control of the Internet financial system, and points out the reasons why the current regulatory measures are still limited. This paper summarizes a research model which is still in its infancy, hoping to open up new prospects and directions for us to understand the cascading behaviors of Internet financial risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

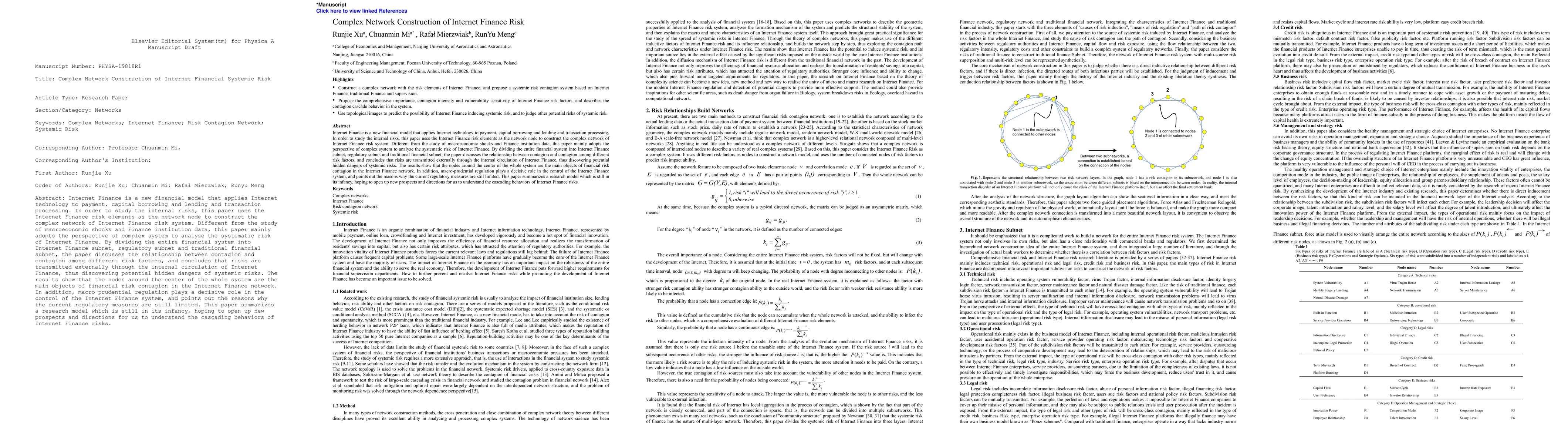

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)