Summary

In this paper we estimate the propagation of liquidity shocks through interbank markets when the information about the underlying credit network is incomplete. We show that techniques such as Maximum Entropy currently used to reconstruct credit networks severely underestimate the risk of contagion by assuming a trivial (fully connected) topology, a type of network structure which can be very different from the one empirically observed. We propose an efficient message-passing algorithm to explore the space of possible network structures, and show that a correct estimation of the network degree of connectedness leads to more reliable estimations for systemic risk. Such algorithm is also able to produce maximally fragile structures, providing a practical upper bound for the risk of contagion when the actual network structure is unknown. We test our algorithm on ensembles of synthetic data encoding some features of real financial networks (sparsity and heterogeneity), finding that more accurate estimations of risk can be achieved. Finally we find that this algorithm can be used to control the amount of information regulators need to require from banks in order to sufficiently constrain the reconstruction of financial networks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

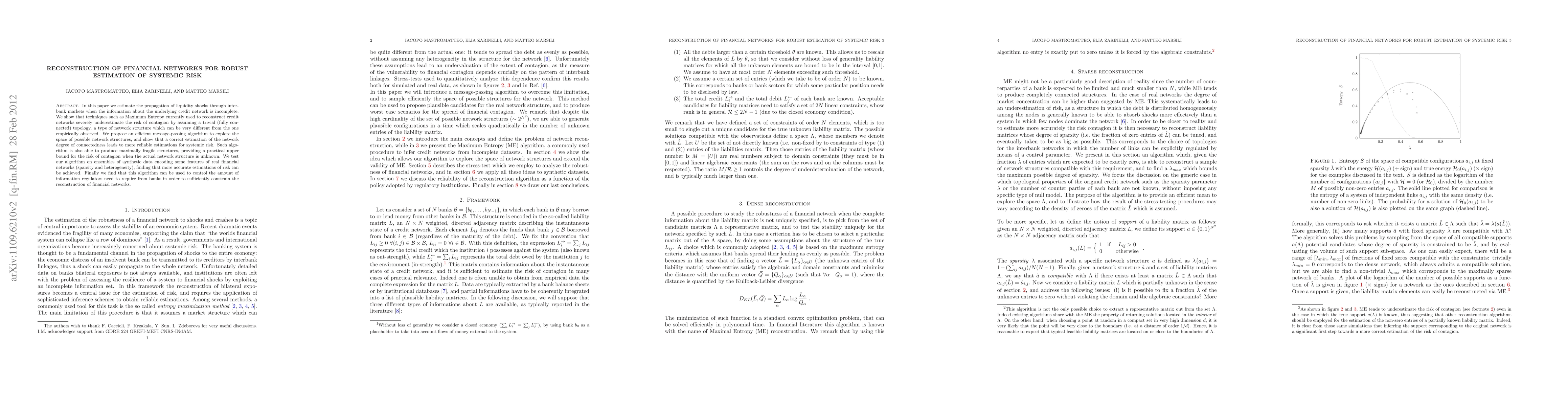

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)