Summary

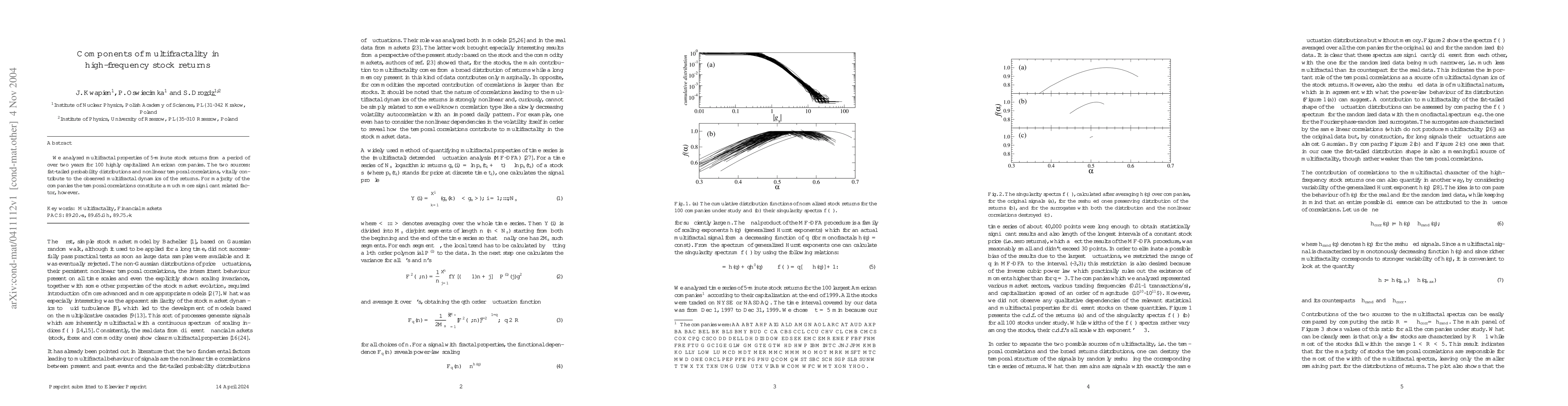

We analyzed multifractal properties of 5-minute stock returns from a period of over two years for 100 highly capitalized American companies. The two sources: fat-tailed probability distributions and nonlinear temporal correlations, vitally contribute to the observed multifractal dynamics of the returns. For majority of the companies the temporal correlations constitute a much more significant related factor, however.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)