Summary

The study investigates the relationship between bank profitability and a comprehensive list of bank specific, industry specific and macroeconomic variables using unique panel data from 23 Bangladeshi banks with large market shares from 2005 to 2019 employing the Pooled Ordinary Least Square (POLS) Method for regression estimation. The random Effect model has been used to check for robustness. Three variables, namely, Return on Asset (ROA), Return on Equity (ROE), and Net Interest Margin (NIM), have been used as profitability proxies. Non-interest income, capital ratio, and GDP growth have been found to have a significant relationship with ROA. In addition to non-interest income, market share, bank size, and real exchange rates are significant explaining variables if profitability is measured as NIM. The only significant determinant of profitability measured by ROE is market share. The primary contribution of this study to the existing knowledge base is an extensive empirical analysis by covering the entire gamut of independent variables (bank specific, industry related, and macroeconomic) to explain the profitability of the banks in Bangladesh. It also covers an extensive and recent data set. Banking sector stakeholders may find great value from the outputs of this paper. Regulators and policymakers may find this useful in undertaking analyses in setting policy rates, banking industry stability, and impact assessment of critical policy measures before and after the enactment, etc. Investors and the bank management are to use the findings of this paper in analyzing the real drivers of profitability of the banks they are contemplating to invest and managing on a daily basis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

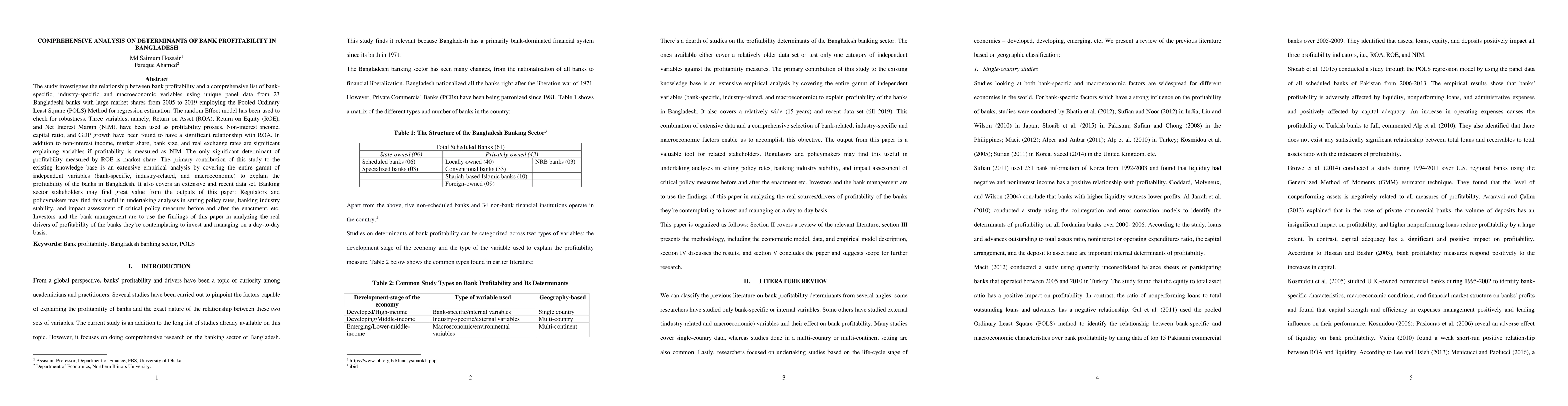

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBank Business Models, Size, and Profitability

F. Bolivar, M. A. Duran, A. Lozano-Vivas

| Title | Authors | Year | Actions |

|---|

Comments (0)