Summary

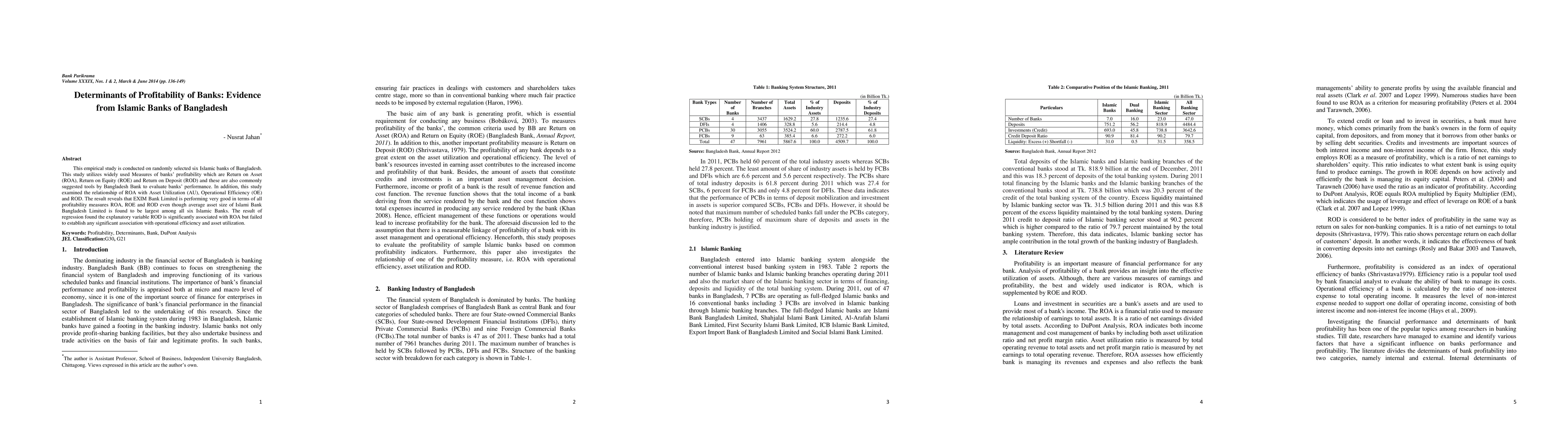

This empirical study is conducted on randomly selected six Islamic banks of Bangladesh. This study utilizes widely used Measures of banks profitability which are Return on Asset (ROA), Return on Equity (ROE) and Return on Deposit (ROD) and these are also commonly suggested tools by Bangladesh Bank to evaluate banks performance. In addition, this study examined the relationship of ROA with Asset Utilization (AU), Operational Efficiency (OE)and ROD. The result reveals that EXIM Bank Limited is performing very good in terms of all profitability measures ROA, ROE and ROD even though average asset size of Islami Bank Bangladesh Limited is found to be largest among all six Islamic Banks. The result of regression found the explanatory variable ROD is significantly associated with ROA but failed to establish any significant association with operational efficiency and asset utilization.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)