Authors

Summary

Using Malliavin calculus techniques we obtain formulas for computing Greeks under different rough Volterra stochastic volatility models. In particular we obtain formulas for rough versions of Stein-Stein, SABR and Bergomi models and numerically demonstrate the convergence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

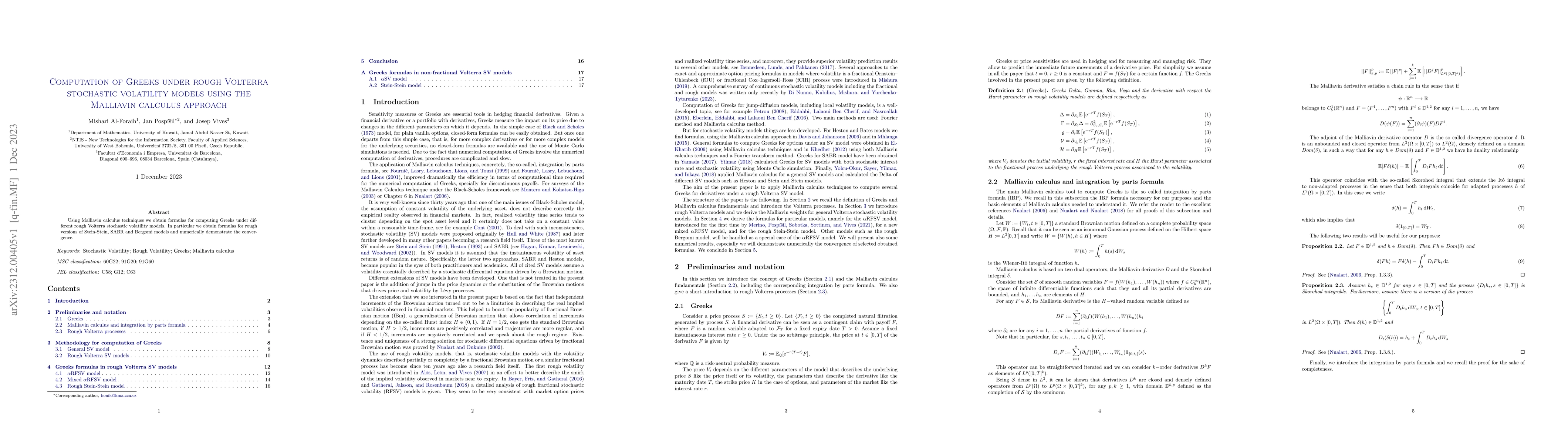

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)