Summary

Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR) are two risk measures which are widely used in the practice of risk management. This paper deals with the problem of computing both VaR and CVaR using stochastic approximation (with decreasing steps): we propose a first Robbins-Monro procedure based on Rockaffelar-Uryasev's identity for the CVaR. The convergence rate of this algorithm to its target satisfies a Gaussian Central Limit Theorem. As a second step, in order to speed up the initial procedure, we propose a recursive importance sampling (I.S.) procedure which induces a significant variance reduction of both VaR and CVaR procedures. This idea, which goes back to the seminal paper of B. Arouna, follows a new approach introduced by V. Lemaire and G. Pag\`es. Finally, we consider a deterministic moving risk level to speed up the initialization phase of the algorithm. We prove that the convergence rate of the resulting procedure is ruled by a Central Limit Theorem with minimal variance and its efficiency is illustrated by considering several typical energy portfolios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

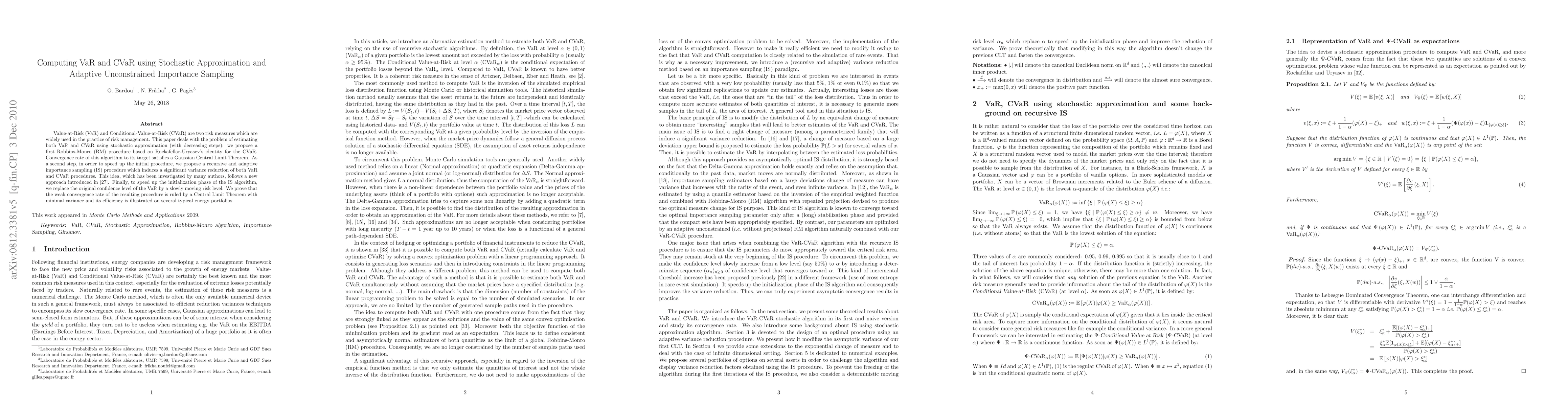

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)