Summary

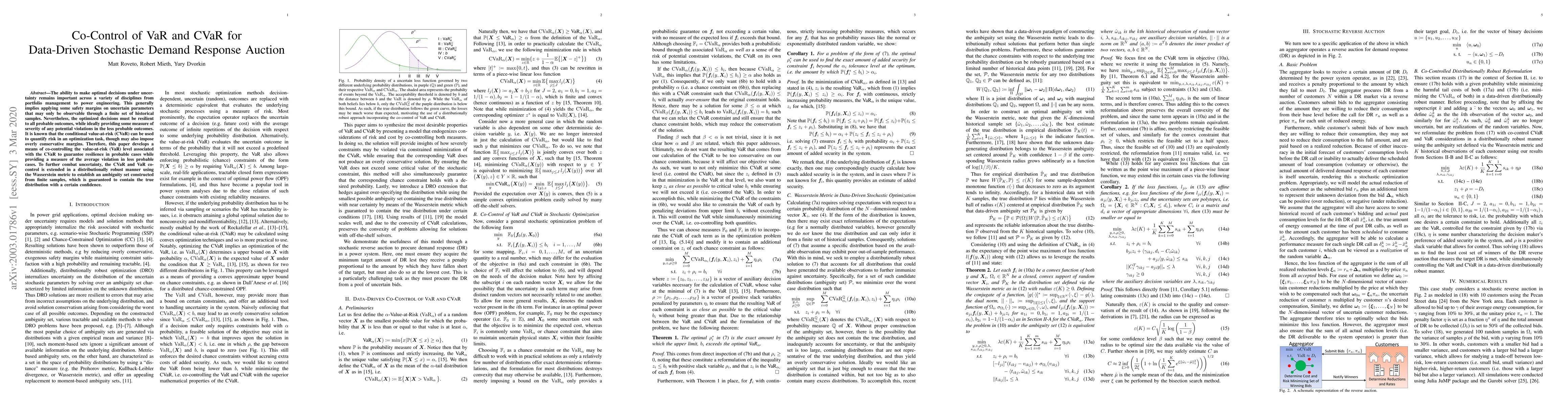

The ability to make optimal decisions under uncertainty remains important across a variety of disciplines from portfolio management to power engineering. This generally implies applying some safety margins on uncertain parameters that may only be observable through a finite set of historical samples. Nevertheless, the optimized decisions must be resilient to all probable outcomes, while ideally providing some measure of severity of any potential violations in the less probable outcomes.It is known that the conditional value-at-risk (CVaR) can be used to quantify risk in an optimization task, though may also impose overly conservative margins. Therefore, this paper develops a means of co-controlling the value-at-risk (VaR) level associated with the CVaR to guarantee resilience in probable cases while providing a measure of the average violation in less probable cases. To further combat uncertainty, the CVaR and VaR co-control is extended in a distributionally robust manner using the Wasserstein metric to establish an ambiguity set constructed from finite samples, which is guaranteed to contain the true distribution with a certain confidence.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVolatility Sensitive Bayesian Estimation of Portfolio VaR and CVaR

Taras Bodnar, Erik Thorsén, Vilhelm Niklasson

No citations found for this paper.

Comments (0)