Authors

Summary

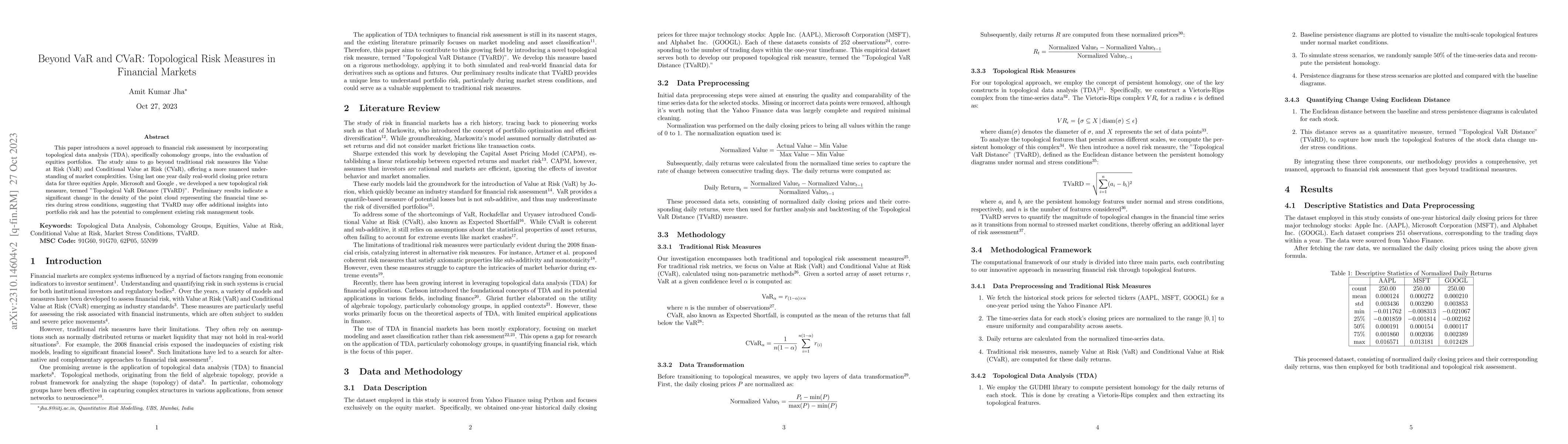

This paper introduces a novel approach to financial risk assessment by incorporating topological data analysis (TDA), specifically cohomology groups, into the evaluation of equities portfolios. The study aims to go beyond traditional risk measures like Value at Risk (VaR) and Conditional Value at Risk (CVaR), offering a more nuanced understanding of market complexities. Using last one year daily real-world closing price return data for three equities Apple, Microsoft and Google , we developed a new topological riskmeasure, termed Topological VaR Distance (TVaRD). Preliminary results indicate a significant change in the density of the point cloud representing the financial time series during stress conditions, suggesting that TVaRD may offer additional insights into portfolio risk and has the potential to complement existing risk management tools.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)