Summary

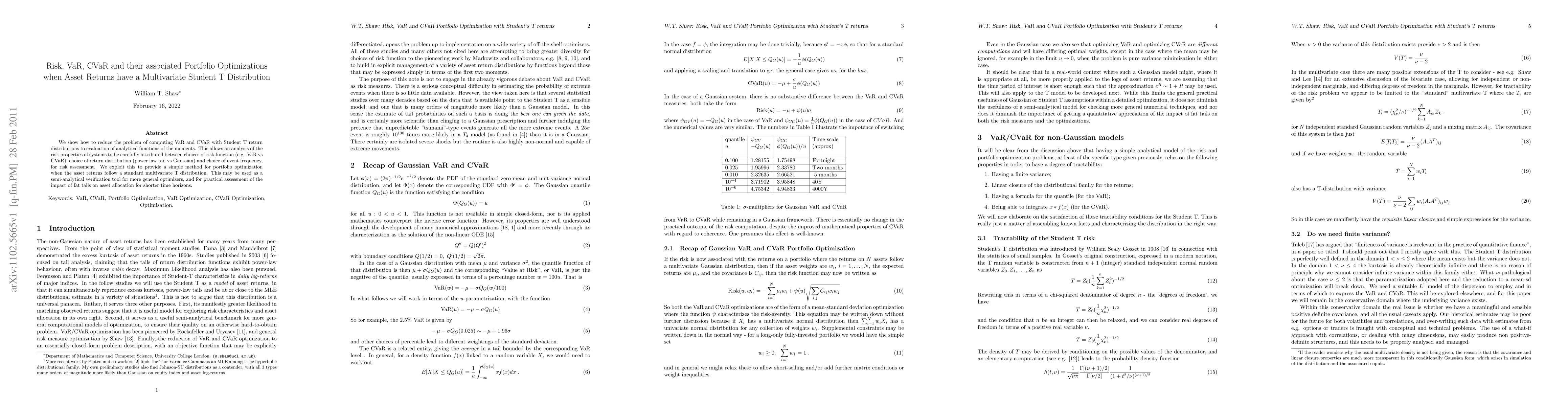

We show how to reduce the problem of computing VaR and CVaR with Student T return distributions to evaluation of analytical functions of the moments. This allows an analysis of the risk properties of systems to be carefully attributed between choices of risk function (e.g. VaR vs CVaR); choice of return distribution (power law tail vs Gaussian) and choice of event frequency, for risk assessment. We exploit this to provide a simple method for portfolio optimization when the asset returns follow a standard multivariate T distribution. This may be used as a semi-analytical verification tool for more general optimizers, and for practical assessment of the impact of fat tails on asset allocation for shorter time horizons.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)