Summary

As systemic risk has become a hot topic in the financial markets, how to measure, allocate and regulate the systemic risk are becoming especially important. However, the financial markets are becoming more and more complicate, which makes the usual study of systemic risk to be restricted. In this paper, we will study the systemic risk measures on a special space $L^{p(\cdot)}$ where the variable exponent $p(\cdot)$ is no longer a given real number like the space $L^{p}$, but a random variable, which reflects the possible volatility of the financial markets. Finally, the dual representation for this new systemic risk measures will be studied. Our results show that every this new systemic risk measure can be decomposed into a convex certain function and a simple-systemic risk measure, which provides a new ideas for dealing with the systemic risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

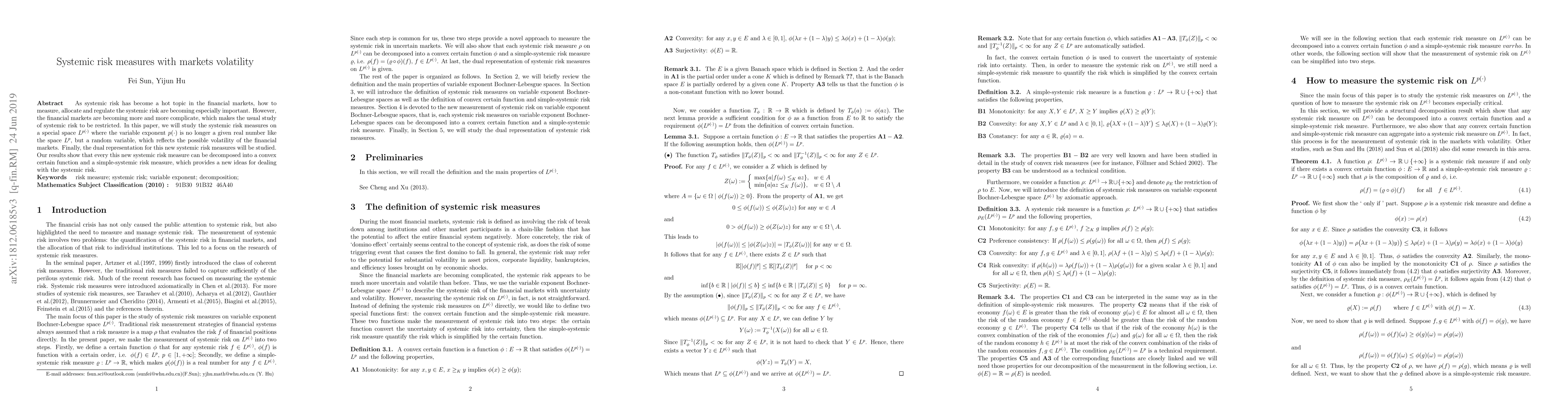

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSystemic risk indicator based on implied and realized volatility

Robert Ślepaczuk, Paweł Sakowski, Rafał Sieradzki

No citations found for this paper.

Comments (0)