Summary

Systemic risk refers to the risk that the financial system is susceptible to failures due to the characteristics of the system itself. The tremendous cost of systemic risk requires the design and implementation of tools for the efficient macroprudential regulation of financial institutions. The current paper proposes a novel approach to measuring systemic risk. Key to our construction is a rigorous derivation of systemic risk measures from the structure of the underlying system and the objectives of a financial regulator. The suggested systemic risk measures express systemic risk in terms of capital endowments of the financial firms. Their definition requires two ingredients: a cash flow or value model that assigns to the capital allocations of the entities in the system a relevant stochastic outcome; and an acceptability criterion, i.e. a set of random outcomes that are acceptable to a regulatory authority. Systemic risk is measured by the set of allocations of additional capital that lead to acceptable outcomes. We explain the conceptual framework and the definition of systemic risk measures, provide an algorithm for their computation, and illustrate their application in numerical case studies. Many systemic risk measures in the literature can be viewed as the minimal amount of capital that is needed to make the system acceptable after aggregating individual risks, hence quantify the costs of a bail-out. In contrast, our approach emphasizes operational systemic risk measures that include both ex post bailout costs as well as ex ante capital requirements and may be used to prevent systemic crises.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

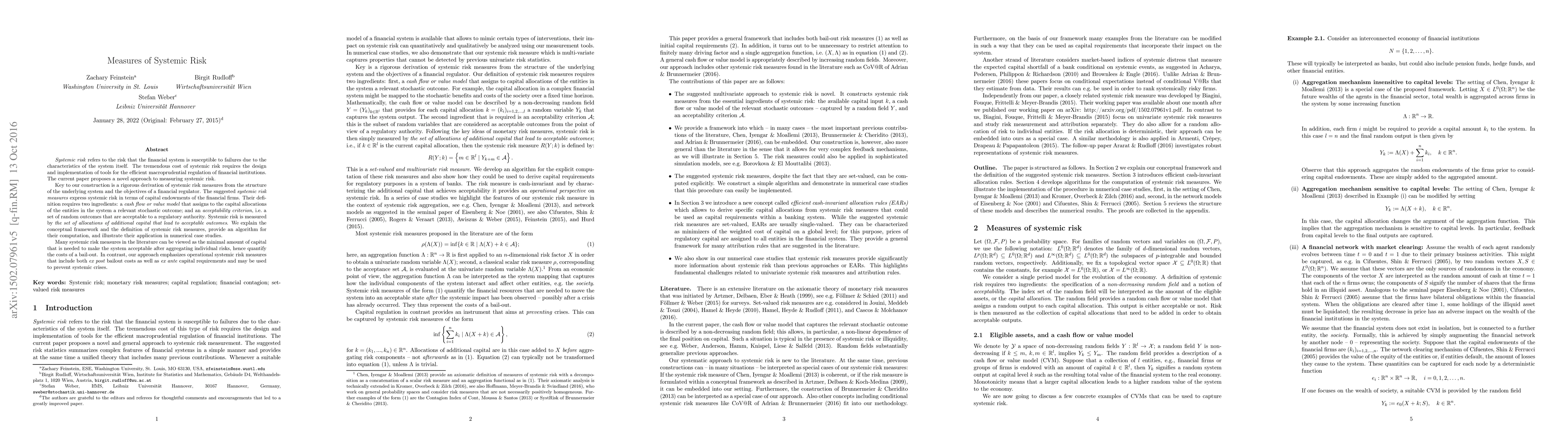

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)