Summary

In this paper, we introduce the rich classes of conditional distortion (CoD) risk measures and distortion risk contribution ($\Delta$CoD) measures as measures of systemic risk and analyze their properties and representations. The classes include the well-known conditional Value-at-Risk, conditional Expected Shortfall, and risk contribution measures in terms of the VaR and ES as special cases. Sufficient conditions are presented for two random vectors to be ordered by the proposed CoD-risk measures and distortion risk contribution measures. These conditions are expressed using the conventional stochastic dominance, increasing convex/concave, dispersive, and excess wealth orders of the marginals and canonical positive/negative stochastic dependence notions. Numerical examples are provided to illustrate our theoretical findings. This paper is the second in a triplet of papers on systemic risk by the same authors. In \cite{DLZorder2018a}, we introduce and analyze some new stochastic orders related to systemic risk. In a third (forthcoming) paper, we attribute systemic risk to the different participants in a given risky environment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

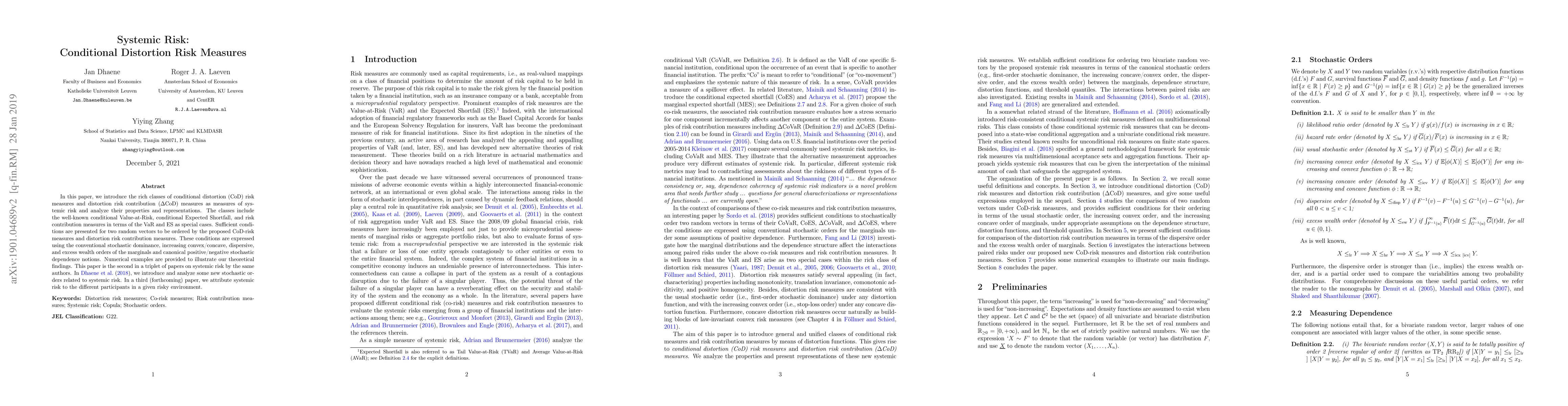

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)