Summary

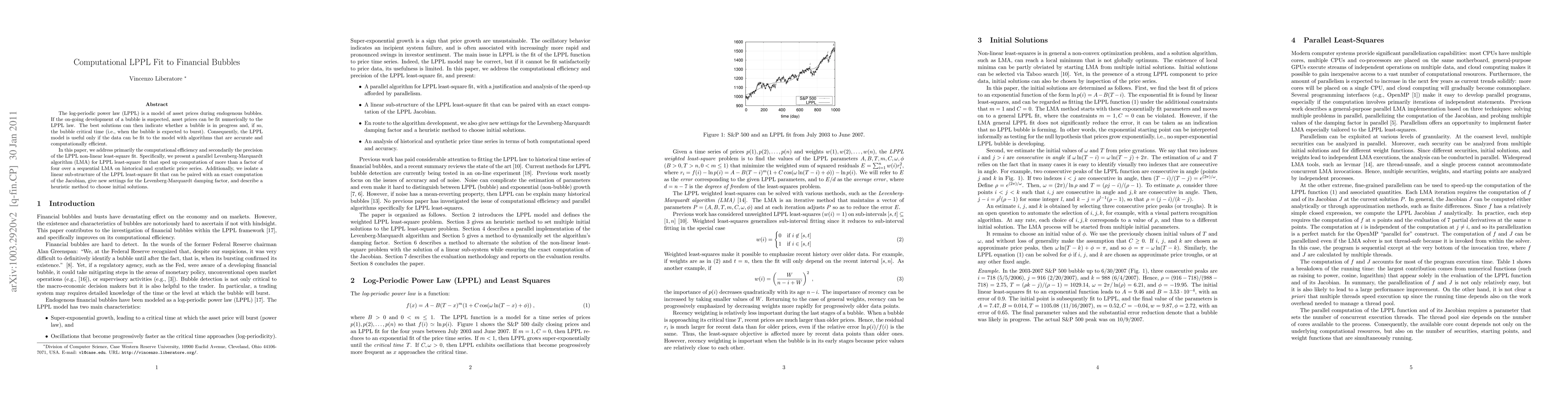

The log-periodic power law (LPPL) is a model of asset prices during endogenous bubbles. If the on-going development of a bubble is suspected, asset prices can be fit numerically to the LPPL law. The best solutions can then indicate whether a bubble is in progress and, if so, the bubble critical time (i.e., when the bubble is expected to burst). Consequently, the LPPL model is useful only if the data can be fit to the model with algorithms that are accurate and computationally efficient. In this paper, we address primarily the computational efficiency and secondarily the precision of the LPPL non-linear least-square fit. Specifically, we present a parallel Levenberg-Marquardt algorithm (LMA) for LPPL least-square fit that sped up computation of more than a factor of four over a sequential LMA on historical and synthetic price series. Additionally, we isolate a linear sub-structure of the LPPL least-square fit that can be paired with an exact computation of the Jacobian, give new settings for the Levenberg-Marquardt damping factor, and describe a heuristic method to choose initial solutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)