Summary

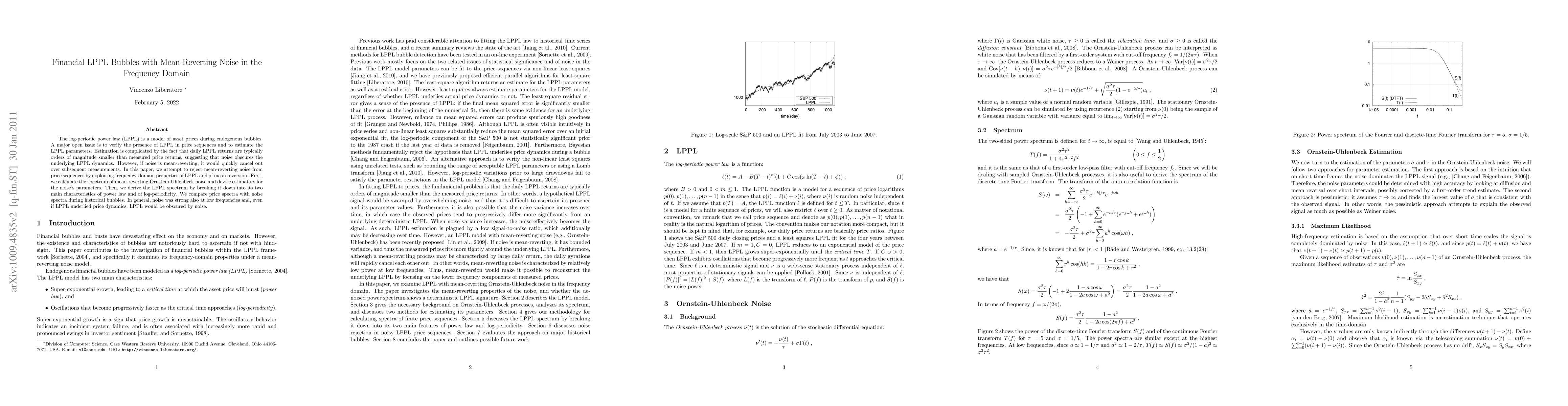

The log-periodic power law (LPPL) is a model of asset prices during endogenous bubbles. A major open issue is to verify the presence of LPPL in price sequences and to estimate the LPPL parameters. Estimation is complicated by the fact that daily LPPL returns are typically orders of magnitude smaller than measured price returns, suggesting that noise obscures the underlying LPPL dynamics. However, if noise is mean-reverting, it would quickly cancel out over subsequent measurements. In this paper, we attempt to reject mean-reverting noise from price sequences by exploiting frequency-domain properties of LPPL and of mean reversion. First, we calculate the spectrum of mean-reverting \ou noise and devise estimators for the noise's parameters. Then, we derive the LPPL spectrum by breaking it down into its two main characteristics of power law and of log-periodicity. We compare price spectra with noise spectra during historical bubbles. In general, noise was strong also at low frequencies and, even if LPPL underlied price dynamics, LPPL would be obscured by noise.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)