Summary

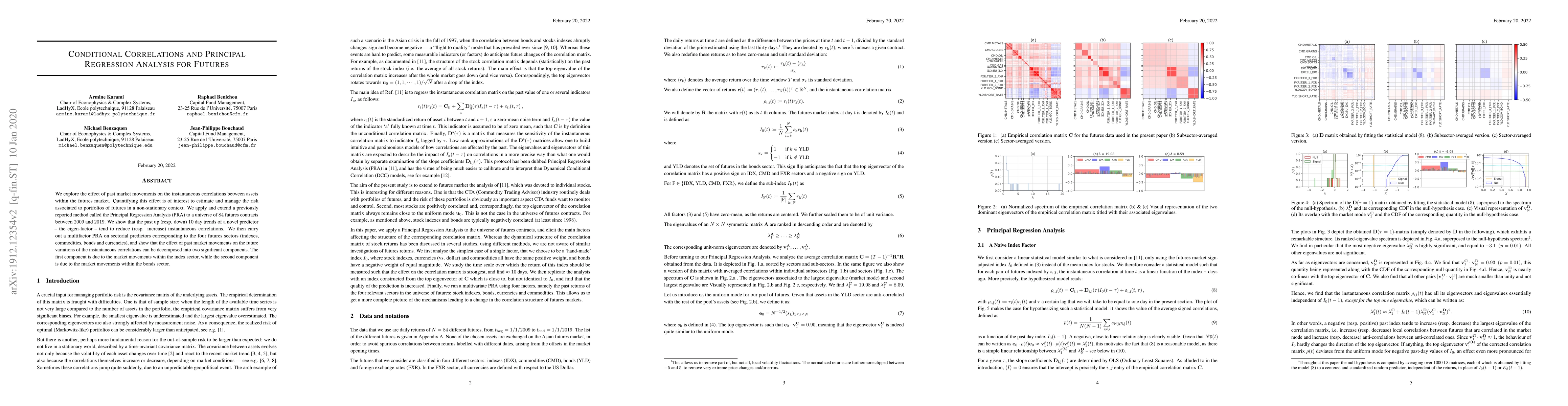

We explore the effect of past market movements on the instantaneous correlations between assets within the futures market. Quantifying this effect is of interest to estimate and manage the risk associated to portfolios of futures in a non-stationary context. We apply and extend a previously reported method called the Principal Regression Analysis (PRA) to a universe of $84$ futures contracts between $2009$ and $2019$. We show that the past up (resp. down) 10 day trends of a novel predictor -- the eigen-factor -- tend to reduce (resp. increase) instantaneous correlations. We then carry out a multifactor PRA on sectorial predictors corresponding to the four futures sectors (indexes, commodities, bonds and currencies), and show that the effect of past market movements on the future variations of the instantaneous correlations can be decomposed into two significant components. The first component is due to the market movements within the index sector, while the second component is due to the market movements within the bonds sector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGeneralized Conditional Functional Principal Component Analysis

Yu Lu, Julia Wrobel, Erjia Cui et al.

Regression based thresholds in principal loading analysis

J. O. Bauer, B. Drabant

| Title | Authors | Year | Actions |

|---|

Comments (0)