Summary

We revisit the index leverage effect, that can be decomposed into a volatility effect and a correlation effect. We investigate the latter using a matrix regression analysis, that we call `Principal Regression Analysis' (PRA) and for which we provide some analytical (using Random Matrix Theory) and numerical benchmarks. We find that downward index trends increase the average correlation between stocks (as measured by the most negative eigenvalue of the conditional correlation matrix), and makes the market mode more uniform. Upward trends, on the other hand, also increase the average correlation between stocks but rotates the corresponding market mode {\it away} from uniformity. There are two time scales associated to these effects, a short one on the order of a month (20 trading days), and a longer time scale on the order of a year. We also find indications of a leverage effect for sectorial correlations as well, which reveals itself in the second and third mode of the PRA.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

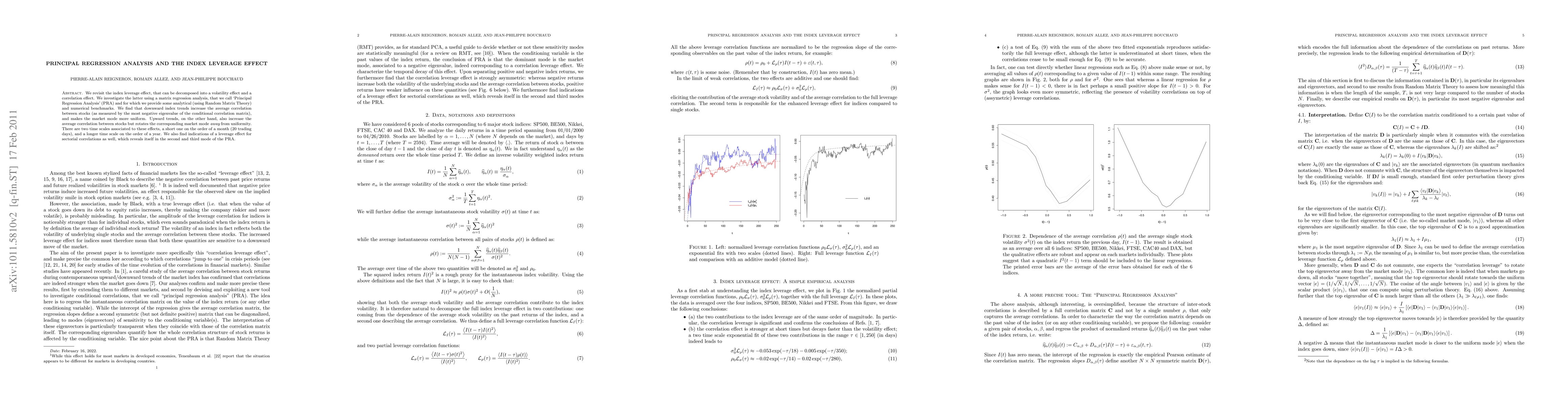

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRegression based thresholds in principal loading analysis

J. O. Bauer, B. Drabant

| Title | Authors | Year | Actions |

|---|

Comments (0)