Summary

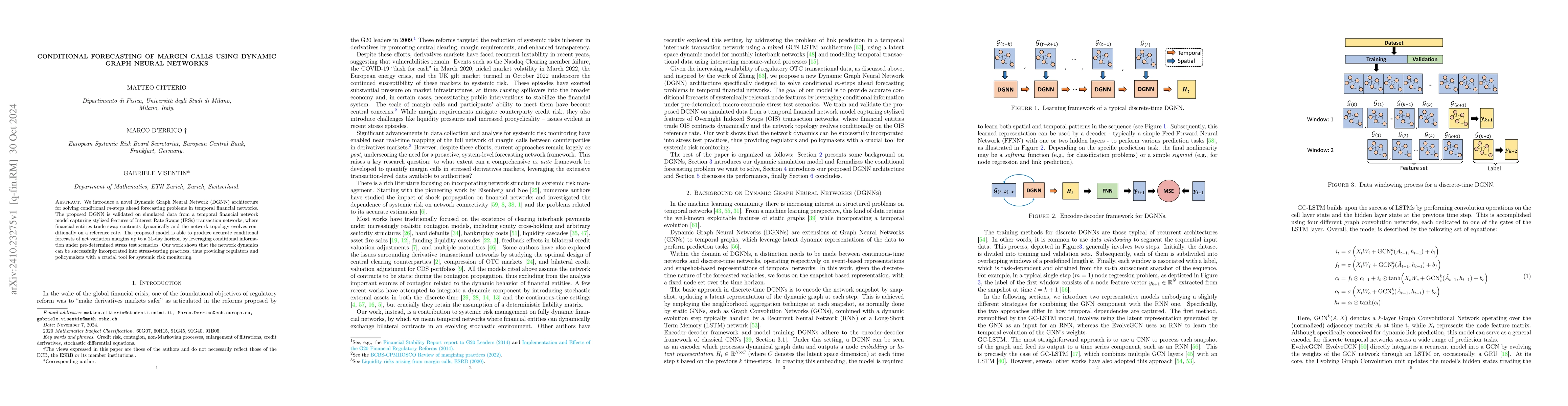

We introduce a novel Dynamic Graph Neural Network (DGNN) architecture for solving conditional $m$-steps ahead forecasting problems in temporal financial networks. The proposed DGNN is validated on simulated data from a temporal financial network model capturing stylized features of Interest Rate Swaps (IRSs) transaction networks, where financial entities trade swap contracts dynamically and the network topology evolves conditionally on a reference rate. The proposed model is able to produce accurate conditional forecasts of net variation margins up to a $21$-day horizon by leveraging conditional information under pre-determined stress test scenarios. Our work shows that the network dynamics can be successfully incorporated into stress-testing practices, thus providing regulators and policymakers with a crucial tool for systemic risk monitoring.

AI Key Findings

Generated Sep 03, 2025

Methodology

The research introduces a Dynamic Graph Neural Network (DGNN) architecture for conditional m-steps ahead forecasting in temporal financial networks, validated on simulated data from a model capturing features of Interest Rate Swaps (IRSs) transaction networks.

Key Results

- The DGNN model accurately forecasts net variation margins up to a 21-day horizon under stress test scenarios.

- The model effectively incorporates network dynamics into stress-testing practices, aiding systemic risk monitoring for regulators and policymakers.

Significance

This work is significant as it provides a novel method for systemic risk monitoring by leveraging the dynamic and interconnected nature of financial systems, potentially enhancing the resilience of financial institutions.

Technical Contribution

The introduction of a DGNN architecture that learns latent node representations and prices contracts dynamically, capturing the stochastic intensity of edge processes in financial networks.

Novelty

The proposed DGNN model stands out by successfully integrating network dynamics into stress-testing practices, offering a novel approach for forecasting in temporal financial networks.

Limitations

- The approach is computationally intensive, limiting its scalability for large networks.

- Results are preliminary, demonstrating the effectiveness of the approach but indicating the need for further development to enhance scalability.

Future Work

- Further research should focus on improving the scalability of the DGNN model for larger financial networks.

- Exploration of real-world datasets to validate the model's performance beyond simulations.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMaximising Weather Forecasting Accuracy through the Utilisation of Graph Neural Networks and Dynamic GNNs

Gaganpreet Singh, Shreelakshmi C R, Surya Durbha

No citations found for this paper.

Comments (0)