Summary

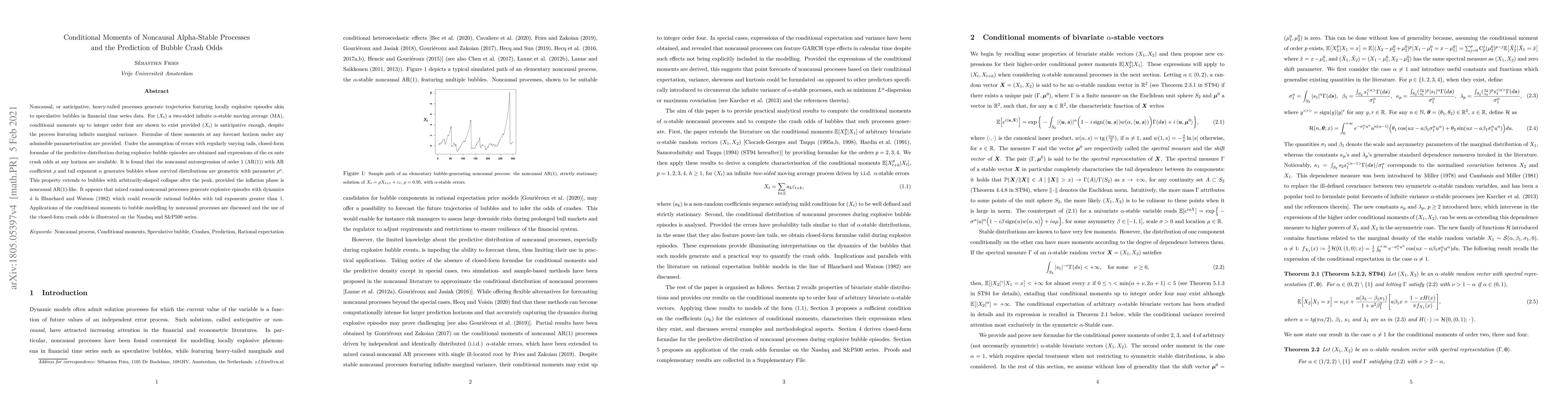

Noncausal, or anticipative, heavy-tailed processes generate trajectories featuring locally explosive episodes akin to speculative bubbles in financial time series data. For $(X_t)$ a two-sided infinite $\alpha$-stable moving average (MA), conditional moments up to integer order four are shown to exist provided $(X_t)$ is anticipative enough, despite the process featuring infinite marginal variance. Formulae of these moments at any forecast horizon under any admissible parameterisation are provided. Under the assumption of errors with regularly varying tails, closed-form formulae of the predictive distribution during explosive bubble episodes are obtained and expressions of the ex ante crash odds at any horizon are available. It is found that the noncausal autoregression of order 1 (AR(1)) with AR coefficient $\rho$ and tail exponent $\alpha$ generates bubbles whose survival distributions are geometric with parameter $\rho^{\alpha}$. This property extends to bubbles with arbitrarily-shaped collapse after the peak, provided the inflation phase is noncausal AR(1)-like. It appears that mixed causal-noncausal processes generate explosive episodes with dynamics \`a la Blanchard and Watson (1982) which could reconcile rational bubbles with tail exponents greater than 1. Applications of the conditional moments to bubble modelling by noncausal processes are discussed and the use of the closed-form crash odds is illustrated on the Nasdaq and S&P500 series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Causal-Noncausal Tail Processes: An Introduction

Yang Lu, Christian Gouriéroux, Christian-Yann Robert

Bubble Detection with Application to Green Bubbles: A Noncausal Approach

Joann Jasiak, Francesco Giancaterini, Alain Hecq et al.

No citations found for this paper.

Comments (0)