Summary

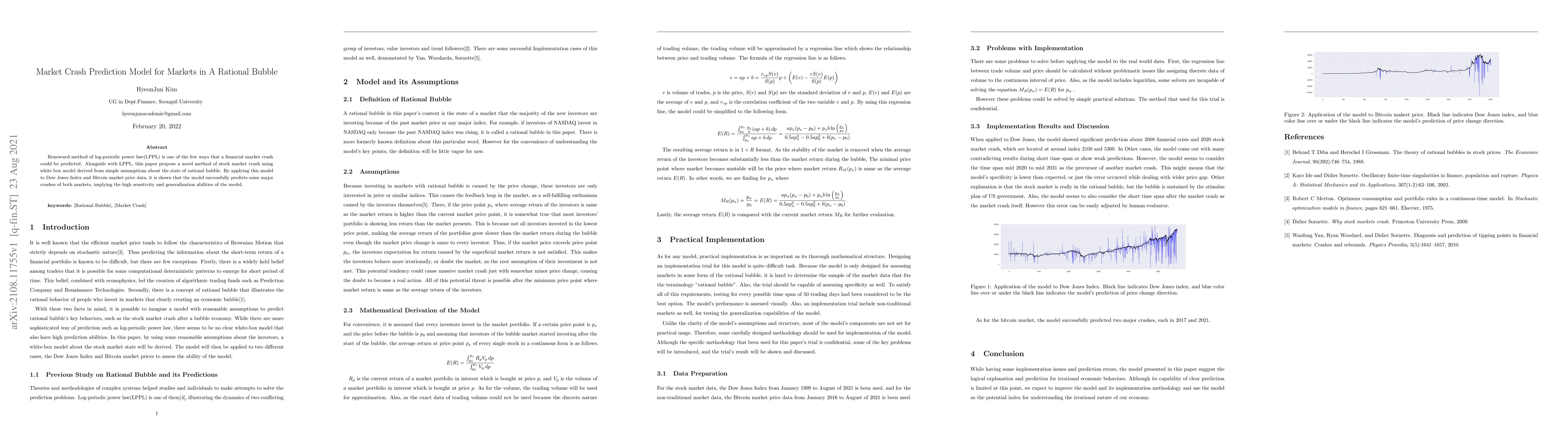

Renowned method of log-periodic power law(LPPL) is one of the few ways that a financial market crash could be predicted. Alongside with LPPL, this paper propose a novel method of stock market crash using white box model derived from simple assumptions about the state of rational bubble. By applying this model to Dow Jones Index and Bitcoin market price data, it is shown that the model successfully predicts some major crashes of both markets, implying the high sensitivity and generalization abilities of the model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInterrogation of A Bubble in the Indian Market

Ganapathy G Gangadharan, N. Suresh

No citations found for this paper.

Comments (0)