Summary

In this article, by using composite asymmetric least squares (CALS) and empirical likelihood, we propose a two-step procedure to estimate the conditional value at risk (VaR) and conditional expected shortfall (ES) for the GARCH series. First, we perform asymmetric least square regressions at several significance levels to model the volatility structure and separate it from the innovation process in the GARCH model. Note that expectile can serve as a bond to make up the gap from VaR estimation to ES estimation because there exists a bijective mapping from expectiles to specific quantile, and ES can be induced by expectile through a simple formula. Then, we introduce the empirical likelihood method to determine the relation above; this method is data-driven and distribution-free. Theoretical studies guarantee the asymptotic properties, such as consistency and the asymptotic normal distribution of the estimator obtained by our proposed method. A Monte Carlo experiment and an empirical application are conducted to evaluate the performance of the proposed method. The results indicate that our proposed estimation method is competitive with some alternative existing tail-related risk estimation methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

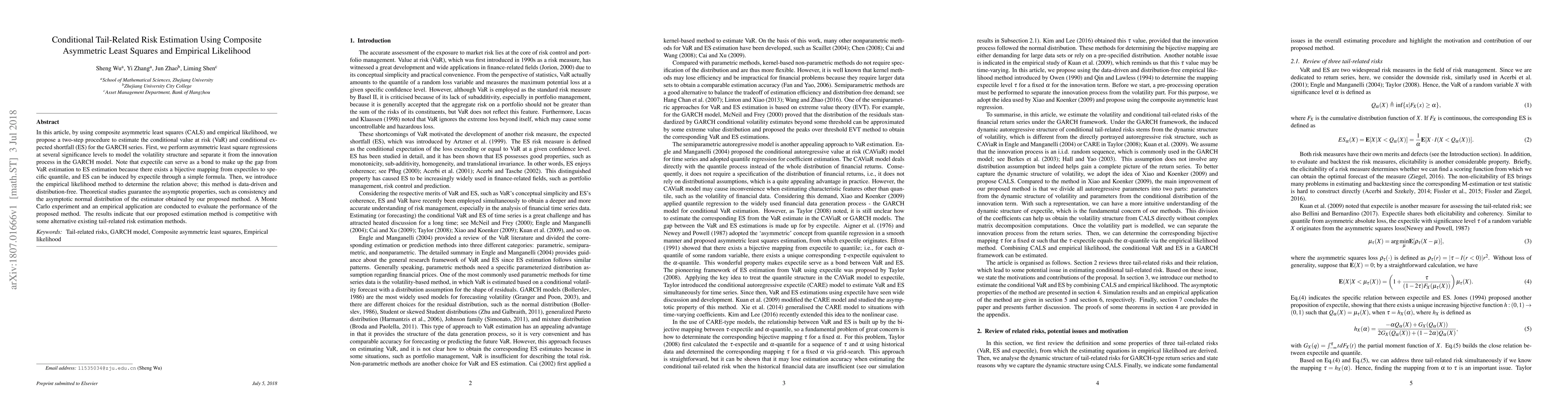

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)