Authors

Summary

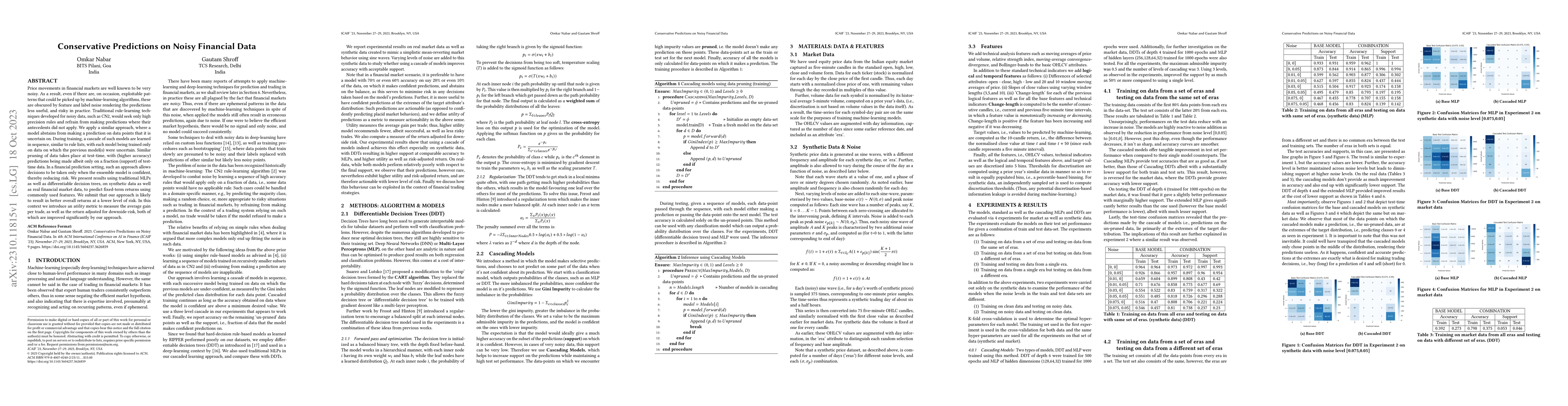

Price movements in financial markets are well known to be very noisy. As a result, even if there are, on occasion, exploitable patterns that could be picked up by machine-learning algorithms, these are obscured by feature and label noise rendering the predictions less useful, and risky in practice. Traditional rule-learning techniques developed for noisy data, such as CN2, would seek only high precision rules and refrain from making predictions where their antecedents did not apply. We apply a similar approach, where a model abstains from making a prediction on data points that it is uncertain on. During training, a cascade of such models are learned in sequence, similar to rule lists, with each model being trained only on data on which the previous model(s) were uncertain. Similar pruning of data takes place at test-time, with (higher accuracy) predictions being made albeit only on a fraction (support) of test-time data. In a financial prediction setting, such an approach allows decisions to be taken only when the ensemble model is confident, thereby reducing risk. We present results using traditional MLPs as well as differentiable decision trees, on synthetic data as well as real financial market data, to predict fixed-term returns using commonly used features. We submit that our approach is likely to result in better overall returns at a lower level of risk. In this context we introduce an utility metric to measure the average gain per trade, as well as the return adjusted for downside risk, both of which are improved significantly by our approach.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploring Robustness of Prefix Tuning in Noisy Data: A Case Study in Financial Sentiment Analysis

Yihao Fang, Sudhandar Balakrishnan, Xioadan Zhu

Corporate Fraud Detection in Rich-yet-Noisy Financial Graph

Shiqi Wang, Zhibo Zhang, Cam-Tu Nguyen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)