Summary

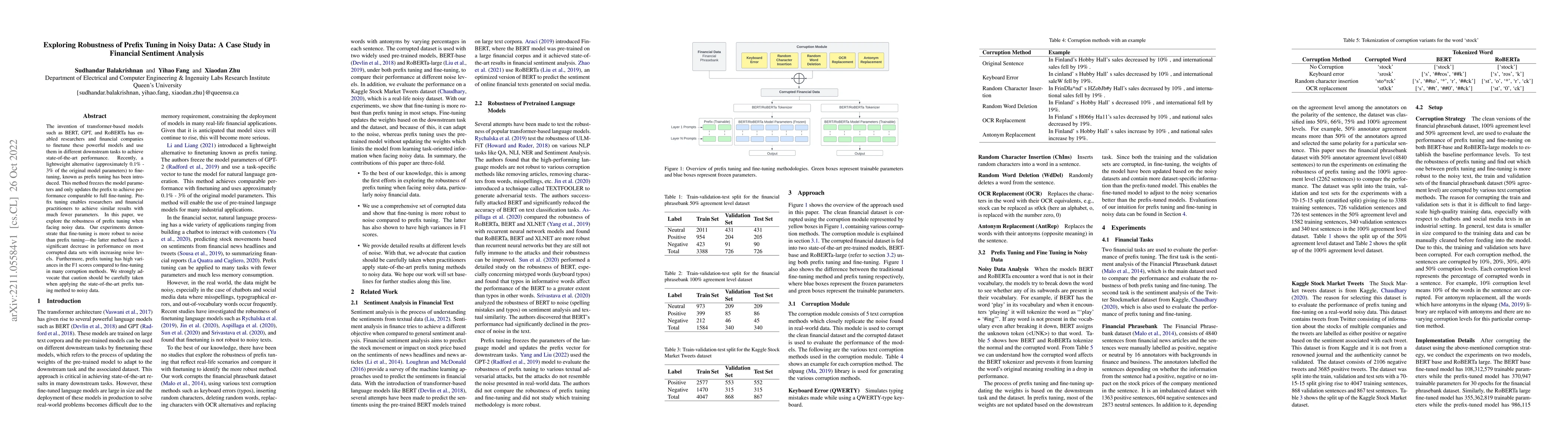

The invention of transformer-based models such as BERT, GPT, and RoBERTa has enabled researchers and financial companies to finetune these powerful models and use them in different downstream tasks to achieve state-of-the-art performance. Recently, a lightweight alternative (approximately 0.1% - 3% of the original model parameters) to fine-tuning, known as prefix tuning has been introduced. This method freezes the model parameters and only updates the prefix to achieve performance comparable to full fine-tuning. Prefix tuning enables researchers and financial practitioners to achieve similar results with much fewer parameters. In this paper, we explore the robustness of prefix tuning when facing noisy data. Our experiments demonstrate that fine-tuning is more robust to noise than prefix tuning -- the latter method faces a significant decrease in performance on most corrupted data sets with increasing noise levels. Furthermore, prefix tuning has high variances in the F1 scores compared to fine-tuning in many corruption methods. We strongly advocate that caution should be carefully taken when applying the state-of-the-art prefix tuning method to noisy data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinancial Sentiment Analysis: Leveraging Actual and Synthetic Data for Supervised Fine-tuning

Abraham Atsiwo

Fine-Tuning Gemma-7B for Enhanced Sentiment Analysis of Financial News Headlines

Chang Yu, Kangtong Mo, Wenyan Liu et al.

Instruct-FinGPT: Financial Sentiment Analysis by Instruction Tuning of General-Purpose Large Language Models

Xiao-Yang Liu, Hongyang Yang, Boyu Zhang

| Title | Authors | Year | Actions |

|---|

Comments (0)