Summary

Nelson and Siegel curves are widely used to fit the observed term structure of interest rates in a particular date. By the other hand, several interest rate models have been developed such their initial forward rate curve can be adjusted to any observed data, as the Ho-Lee and the Hull and White one factor models. In this work we study the evolution of the forward curve process for each of this models assuming that the initial curve is of Nelson-Siegel type. We conclude that the forward curve process produces curves belonging to a parametric family of curves that can be seen as extended Nelson and Siegel curves.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

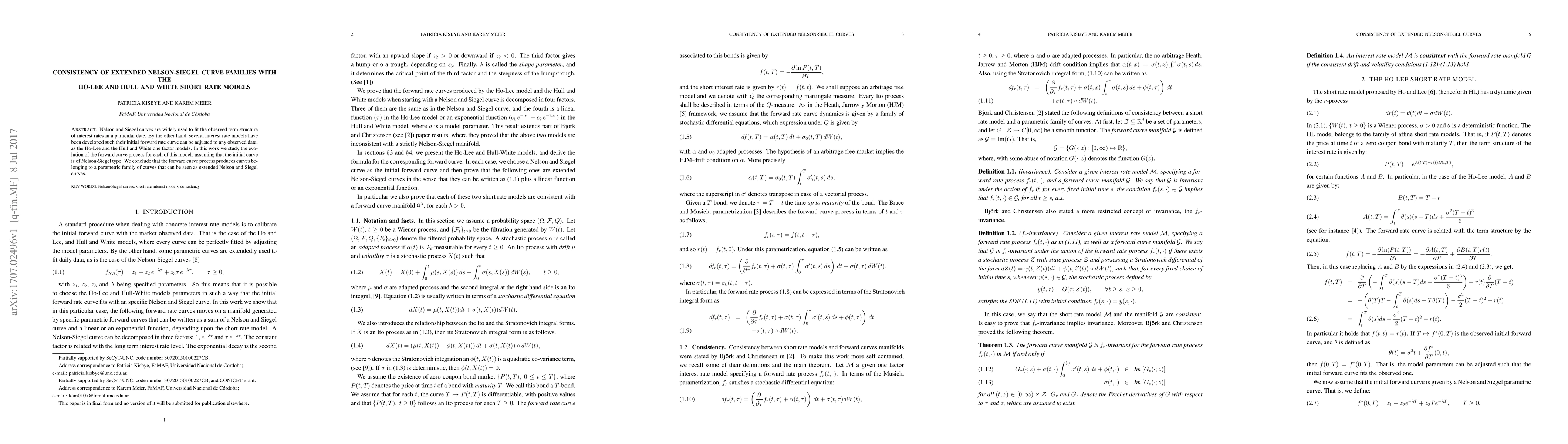

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe geometry of multi-curve interest rate models

Claudio Fontana, Giacomo Lanaro, Agatha Murgoci

No citations found for this paper.

Comments (0)