Summary

Yield curve modeling is an essential problem in finance. In this work, we explore the use of Bayesian statistical methods in conjunction with Nelson-Siegel model. We present the hierarchical Bayesian model for the parameters of the Nelson-Siegel yield function. We implement the MAP estimates via BFGS algorithm in rstan. The Bayesian analysis relies on the Monte Carlo simulation method. We perform the Hamiltonian Monte Carlo (HMC), using the rstan package. As a by-product of the HMC, we can simulate the Monte Carlo price of a Bond, and it helps us to identify if the bond is over-valued or under-valued. We demonstrate the process with an experiment and US Treasury's yield curve data. One of the interesting observation of the experiment is that there is a strong negative correlation between the price and long-term effect of yield. However, the relationship between the short-term interest rate effect and the value of the bond is weakly positive. This is because posterior analysis shows that the short-term effect and the long-term effect are negatively correlated.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

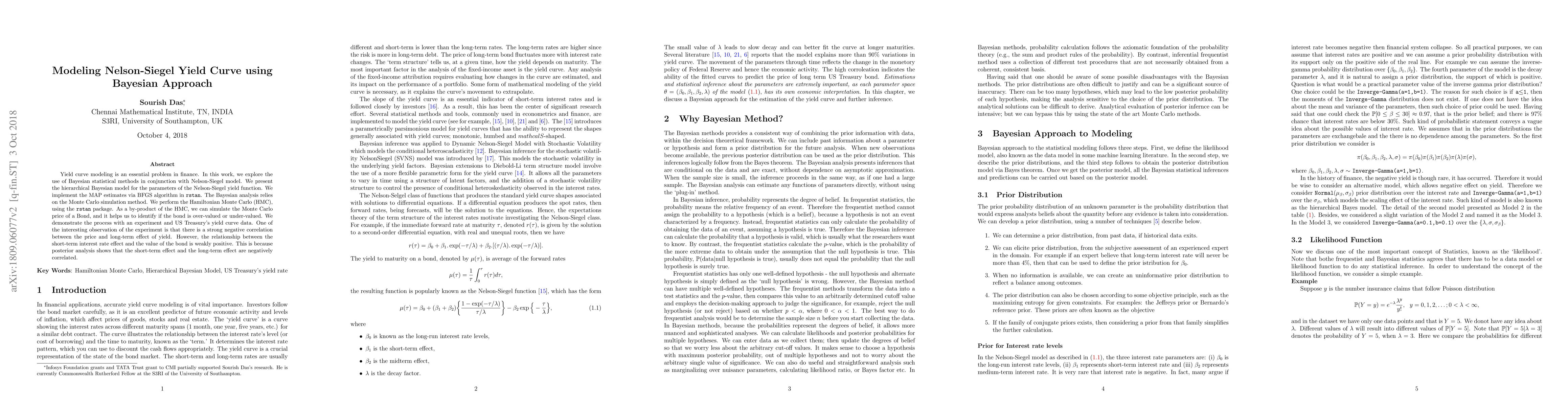

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModeling the yield curve of Burundian bond market by parametric models

Rédempteur Ntawiratsa, David Niyukuri, Irène Irakoze et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)