Summary

We present an arbitrage-free non-parametric yield curve prediction model which takes the full (discretized) yield curve as state variable. We believe that absence of arbitrage is an important model feature in case of highly correlated data, as it is the case for interest rates. Furthermore, the model structure allows to separate clearly the tasks of estimating the volatility structure and of calibrating market prices of risk. The empirical part includes tests on modeling assumptions, back testing and a comparison with the Vasi\v{c}ek short rate model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

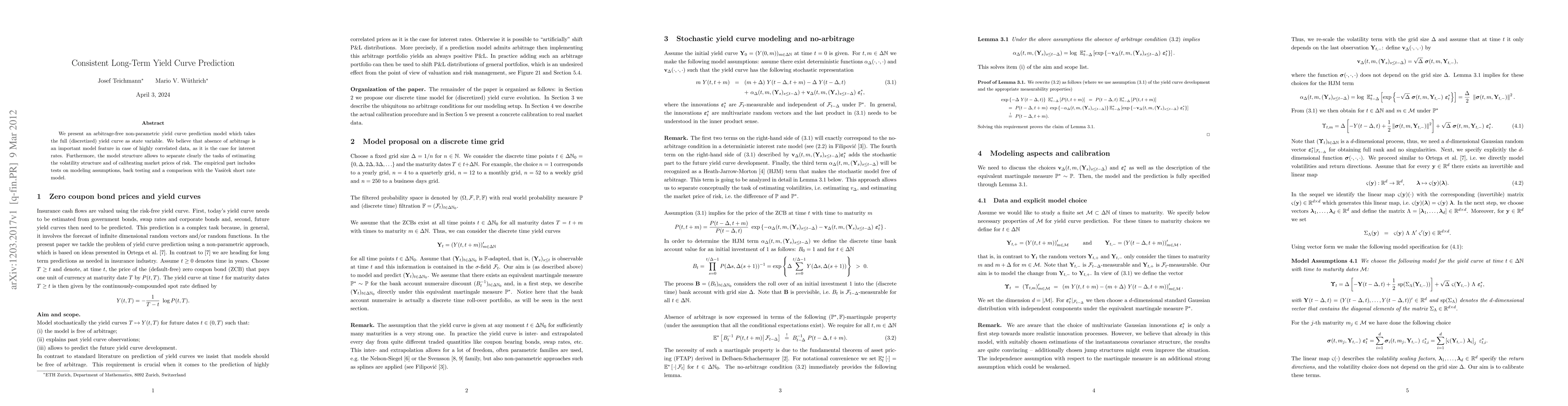

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTowards Consistent Long-Term Pose Generation

Jason Corso, Yayuan Li, Filippos Bellos

| Title | Authors | Year | Actions |

|---|

Comments (0)