Summary

The purpose of this paper relies on the study of long term yield curves modeling. Inspired by the economic litterature, it provides a financial interpretation of the Ramsey rule that links discount rate and marginal utility of aggregate optimal consumption. For such a long maturity modelization, the possibility of adjusting preferences to new economic information is crucial. Thus, after recalling some important properties on progressive utility, this paper first provides an extension of the notion of a consistent progressive utility to a consistent pair of progressive utilities of investment and consumption. An optimality condition is that the utility from the wealth satisfies a second order SPDE of HJB type involving the Fenchel-Legendre transform of the utility from consumption. This SPDE is solved in order to give a full characterization of this class of consistent progressive pair of utilities. An application of this results is to revisit the classical backward optimization problem in the light of progressive utility theory, emphasizing intertemporal-consistency issue. Then we study the dynamics of the marginal utility yield curve, and give example with backward and progressive power utilities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

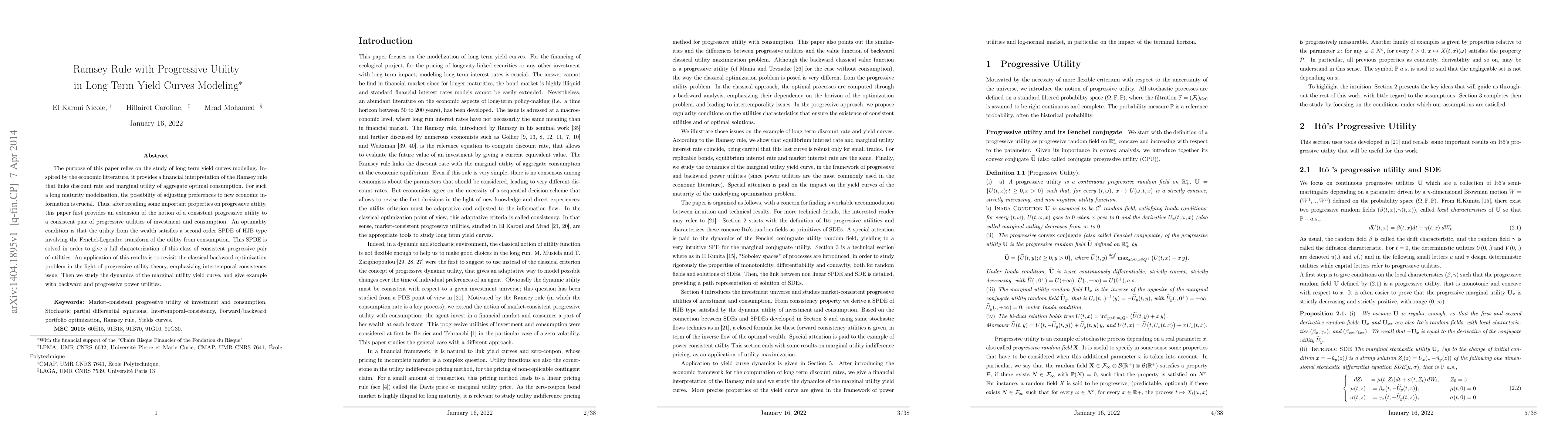

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)