Summary

This paper describes a consistent and arbitrage-free pricing methodology for bespoke CDO tranches. The proposed method is a multi-factor extension to the (Li 2009) model, and it is free of the known flaws in the current standard pricing method of base correlation mapping. This method assigns a distinct market factor to each liquid credit index and models the correlation between these market factors explicitly. A low-dimensional semi-analytical Monte Carlo is shown to be very efficient in computing the PVs and risks of bespoke tranches. Numerical examples show that resulting bespoke tranche prices are generally in line with the current standard method of base correlation with TLP mapping. Practical issues such as model deltas and quanto adjustment are also discussed as numerical examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

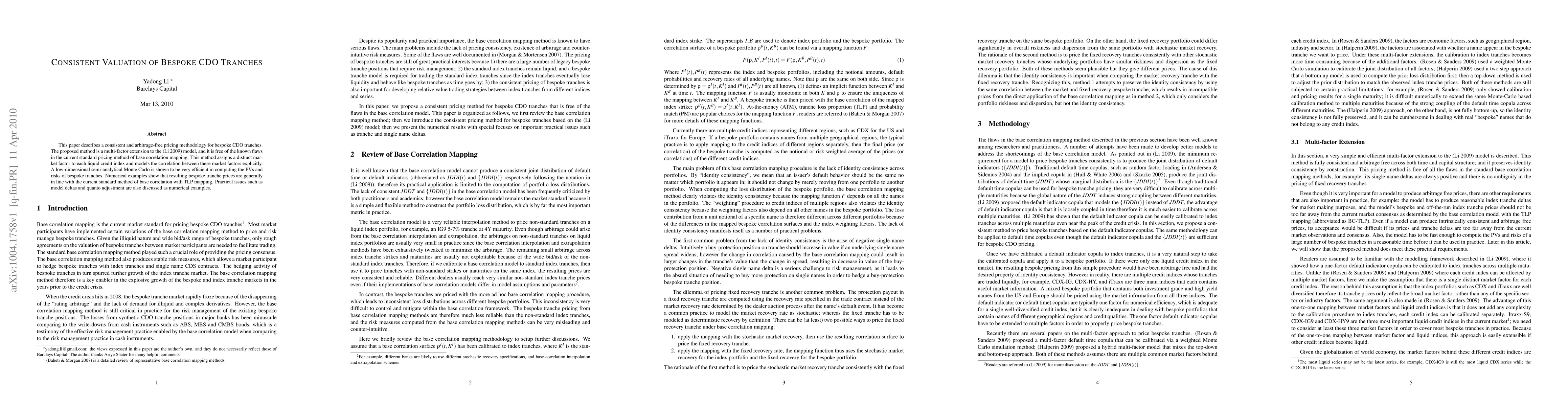

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)