Summary

In this work we derive an approximated no-arbitrage market valuation formula for Constant Maturity Credit Default Swaps (CMCDS). We move from the CDS options market model in Brigo (2004), and derive a formula for CMCDS that is the analogous of the formula for constant maturity swaps in the default free swap market under the LIBOR market model. A "convexity adjustment"-like correction is present in the related formula. Without such correction, or with zero correlations, the formula returns an obvious deterministic-credit-spread expression for the CMCDS price. To obtain the result we derive a joint dynamics of forward CDS rates under a single pricing measure, as in Brigo (2004). Numerical examples of the "convexity adjustment" impact complete the paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

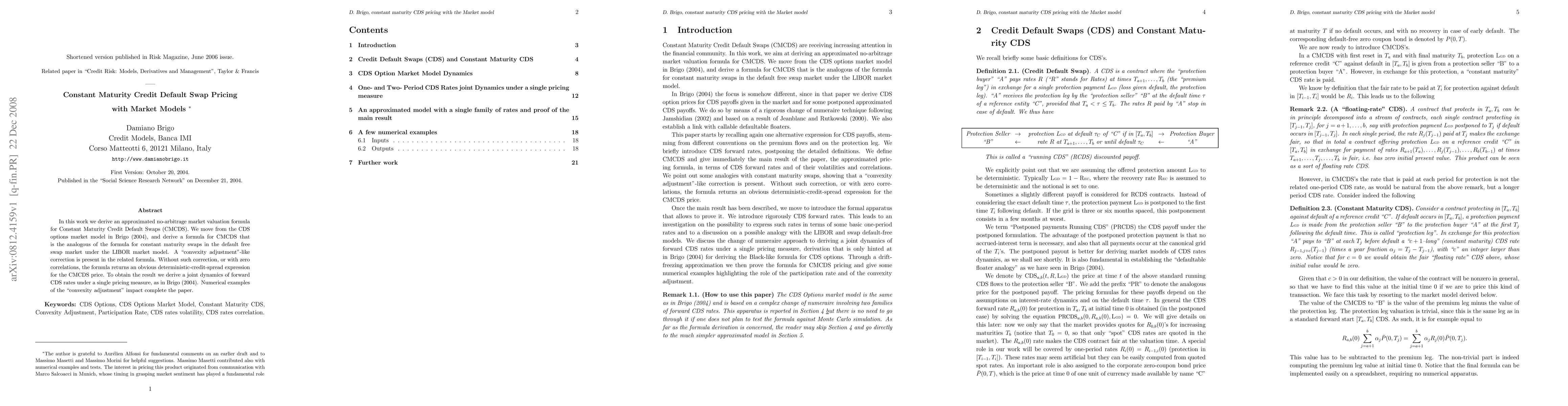

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)